Question: Question 2 (6 points) You plan to construct portfolio using two risky assets S&P500 Index ETF (VFINX) and US 10-year Treasury-Bond ETF (IEF). Your fundamental

Question 2 (6 points)

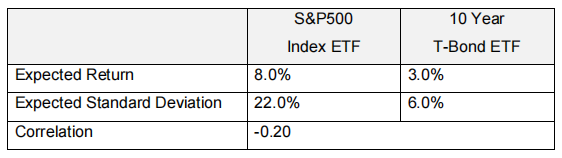

You plan to construct portfolio using two risky assets S&P500 Index ETF (VFINX) and US 10-year Treasury-Bond ETF (IEF). Your fundamental research team provided you with the long-term expected return and risk as follows:

(1) Complete the investment opportunity set table by calculating portfolio expected return and standard deviation per the different combination of stock and bond weight.

o Set the stock index fund weighting range between -20% and 120% with 10% points interval (-20% means you short index fund to buy bond by 20%)

| Investement Opportunity Set Table | |||

| Weight | Weight | Expected | Standard |

| Equity | Bonds | Return | Deviation |

| -20% | 120% | ||

| -10% | 110% | ||

| 0% | 100% | ||

| 10% | 90% | ||

| 20% | 80% | ||

| 30% | 70% | ||

| 40% | 60% | ||

| 50% | 50% | ||

| 60% | 40% | ||

| 70% | 30% | ||

| 80% | 20% | ||

| 90% | 10% | ||

| 100% | 0% | ||

| 110% | -10% | ||

| 120% | -20% |

(2) If the two assets have a perfect negative correlation (i.e. = -1), approximately how much return can you achieve by constructing arbitrage portfolio with zero risk?

o For the answer, a single digit % number is enough (e.g. 8%).

S&P500 10 Year T-Bond ETF Index ETF 8.0% 3.0% Expected Return Expected Standard Deviation Correlation 22.0% 6.0% -0.20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts