Question: Question 2: 6 points . You work as an analyst for an institution located in Ras Al Khaimah, United Arab Emirates. The country's Monetary Authority,

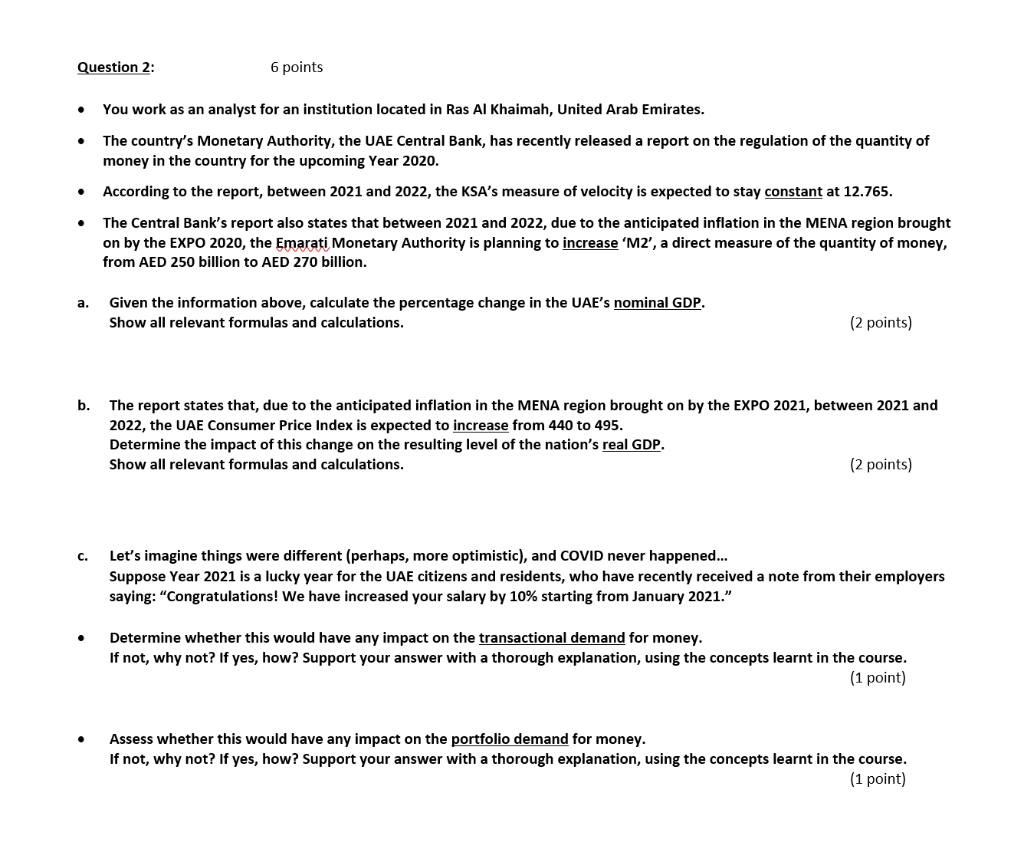

Question 2: 6 points . You work as an analyst for an institution located in Ras Al Khaimah, United Arab Emirates. The country's Monetary Authority, the UAE Central Bank, has recently released a report on the regulation of the quantity of money in the country for the upcoming Year 2020. According to the report, between 2021 and 2022, the KSA's measure of velocity is expected to stay constant at 12.765. The Central Bank's report also states that between 2021 and 2022, due to the anticipated inflation in the MENA region brought on by the EXPO 2020, the Emarati Monetary Authority is planning to increase 'M2', a direct measure of the quantity of money, from AED 250 billion to AED 270 billion. . . a. Given the information above, calculate the percentage change in the UAE's nominal GDP. Show all relevant formulas and calculations. (2 points) b. The report states that, due to the anticipated inflation in the MENA region brought on by the EXPO 2021, between 2021 and 2022, the UAE Consumer Price Index is expected to increase from 440 to 495. Determine the impact of this change on the resulting level of the nation's real GDP. Show all relevant formulas and calculations. (2 points) c. Let's imagine things were different (perhaps, more optimistic), and COVID never happened... Suppose Year 2021 is a lucky year for the UAE citizens and residents, who have recently received a note from their employers saying: "Congratulations! We have increased your salary by 10% starting from January 2021." Determine whether this would have any impact on the transactional demand for money. If not, why not? If yes, how? Support your answer with a thorough explanation, using the concepts learnt in the course. (1 point) Assess whether this would have any impact on the portfolio demand for money. If not, why not? If yes, how? Support your answer with a thorough explanation, using the concepts learnt in the course. (1 point) Question 2: 6 points . You work as an analyst for an institution located in Ras Al Khaimah, United Arab Emirates. The country's Monetary Authority, the UAE Central Bank, has recently released a report on the regulation of the quantity of money in the country for the upcoming Year 2020. According to the report, between 2021 and 2022, the KSA's measure of velocity is expected to stay constant at 12.765. The Central Bank's report also states that between 2021 and 2022, due to the anticipated inflation in the MENA region brought on by the EXPO 2020, the Emarati Monetary Authority is planning to increase 'M2', a direct measure of the quantity of money, from AED 250 billion to AED 270 billion. . . a. Given the information above, calculate the percentage change in the UAE's nominal GDP. Show all relevant formulas and calculations. (2 points) b. The report states that, due to the anticipated inflation in the MENA region brought on by the EXPO 2021, between 2021 and 2022, the UAE Consumer Price Index is expected to increase from 440 to 495. Determine the impact of this change on the resulting level of the nation's real GDP. Show all relevant formulas and calculations. (2 points) c. Let's imagine things were different (perhaps, more optimistic), and COVID never happened... Suppose Year 2021 is a lucky year for the UAE citizens and residents, who have recently received a note from their employers saying: "Congratulations! We have increased your salary by 10% starting from January 2021." Determine whether this would have any impact on the transactional demand for money. If not, why not? If yes, how? Support your answer with a thorough explanation, using the concepts learnt in the course. (1 point) Assess whether this would have any impact on the portfolio demand for money. If not, why not? If yes, how? Support your answer with a thorough explanation, using the concepts learnt in the course. (1 point)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts