Question: Question 2 (60 Points) Regarding the given cases, please choose the proper category and assertion. (4 points per cell) Categories are Transaction and Events and

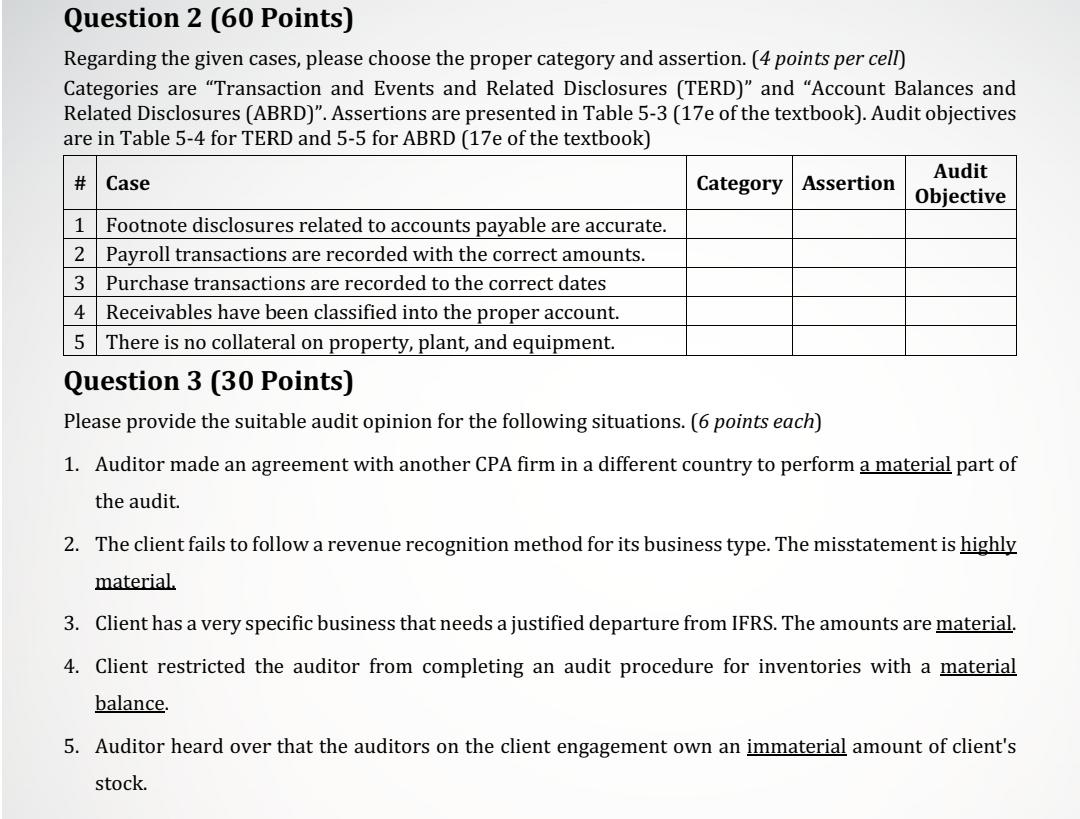

Question 2 (60 Points) Regarding the given cases, please choose the proper category and assertion. (4 points per cell) Categories are "Transaction and Events and Related Disclosures (TERD)" and "Account Balances and Related Disclosures (ABRD)". Assertions are presented in Table 5-3 (17e of the textbook). Audit objectives are in Table 5-4 for TERD and 5-5 for ABRD (17e of the textbook) Audit # Case Category Assertion Objective 1 Footnote disclosures related to accounts payable are accurate. 2 Payroll transactions are recorded with the correct amounts. 3 Purchase transactions are recorded to the correct dates 4 Receivables have been classified into the proper account. 5 There is no collateral on property, plant, and equipment. Question 3 (30 Points) Please provide the suitable audit opinion for the following situations. (6 points each) 1. Auditor made an agreement with another CPA firm in a different country to perform a material part of the audit. 2. The client fails to follow a revenue recognition method for its business type. The misstatement is highly material. 3. Client has a very specific business that needs a justified departure from IFRS. The amounts are material. 4. Client restricted the auditor from completing an audit procedure for inventories with a material balance. 5. Auditor heard over that the auditors on the client engagement own an immaterial amount of client's stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts