Question: QUESTION 2 [7 marks] A short forward contract with exactly 360 days to maturity on a stock is entered into when the stock price is

![QUESTION 2 [7 marks] A short forward contract with exactly 360](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fe53ae19ab7_59766fe53ad80fe2.jpg)

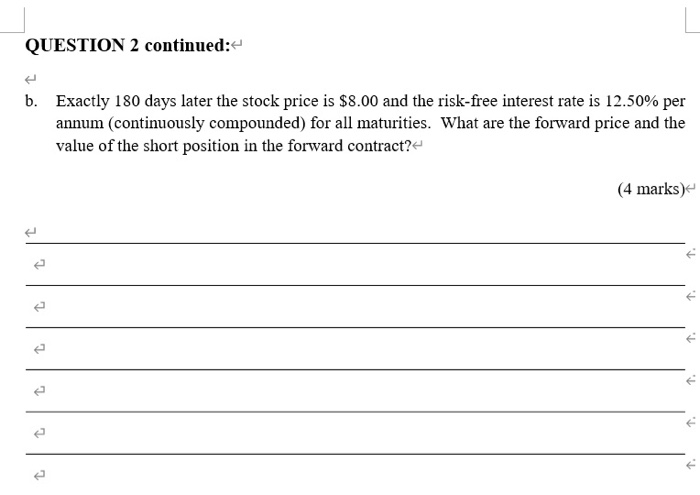

QUESTION 2 [7 marks] A short forward contract with exactly 360 days to maturity on a stock is entered into when the stock price is $9.00 and the risk-free interest rate is 15.00% per annum with continuous compounding for all maturities. The stock is certain to pay dividends per share of 20 cents in 60 days-time and 30 cents in 270 days-time. Assume one year is 365 days. Required: a. What are the forward price and the initial value of the forward contract? (3 marks) QUESTION 2 continued: b. Exactly 180 days later the stock price is $8.00 and the risk-free interest rate is 12.50% per annum (continuously compounded) for all maturities. What are the forward price and the value of the short position in the forward contract? (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts