Question: Question 2 (7 marks): Jake will be offered the following stream of investment payments over the next four years: $600 at the end of 1st

Question 2 (7 marks): Jake will be offered the following stream of investment payments over the next four years:

$600at the end of 1st year,

$100at the end of

2^(nd )year,

$400at the end of the

3^(rd )year, and

$100at the end of

4^(th )year. Alternatively, he can have a lump sum of

$1000immediately. He expects to earn

6%annual interest compounded semi-annually on his investments.\ (a) (5 marks)Which offer does he prefer (think carefully of what interest rate to use)?\ (b) (2 marks)What is the minimum amount he would accept now instead of getting the stream of investment payments?\ Question 3 (8 marks): A fixed-rate mortgage of

$300,000is arranged with annual rate

6%. The loan is to be fully amortized in 25 years with monthly payments. Term is 3 years.\ (a) (1 mark) what is the compounding frequency of the mortgage?\ (b) (3 marks)What is the outstanding balance of the mortgage at the end of the term?\ (c) mark)What is the total amount of interest payments made over the entire amortization period?\ (d) (3 marks) What is the interest component made for the

3^(rd )month? Principal component for the same month?\ \ \ Show full work for all the question.

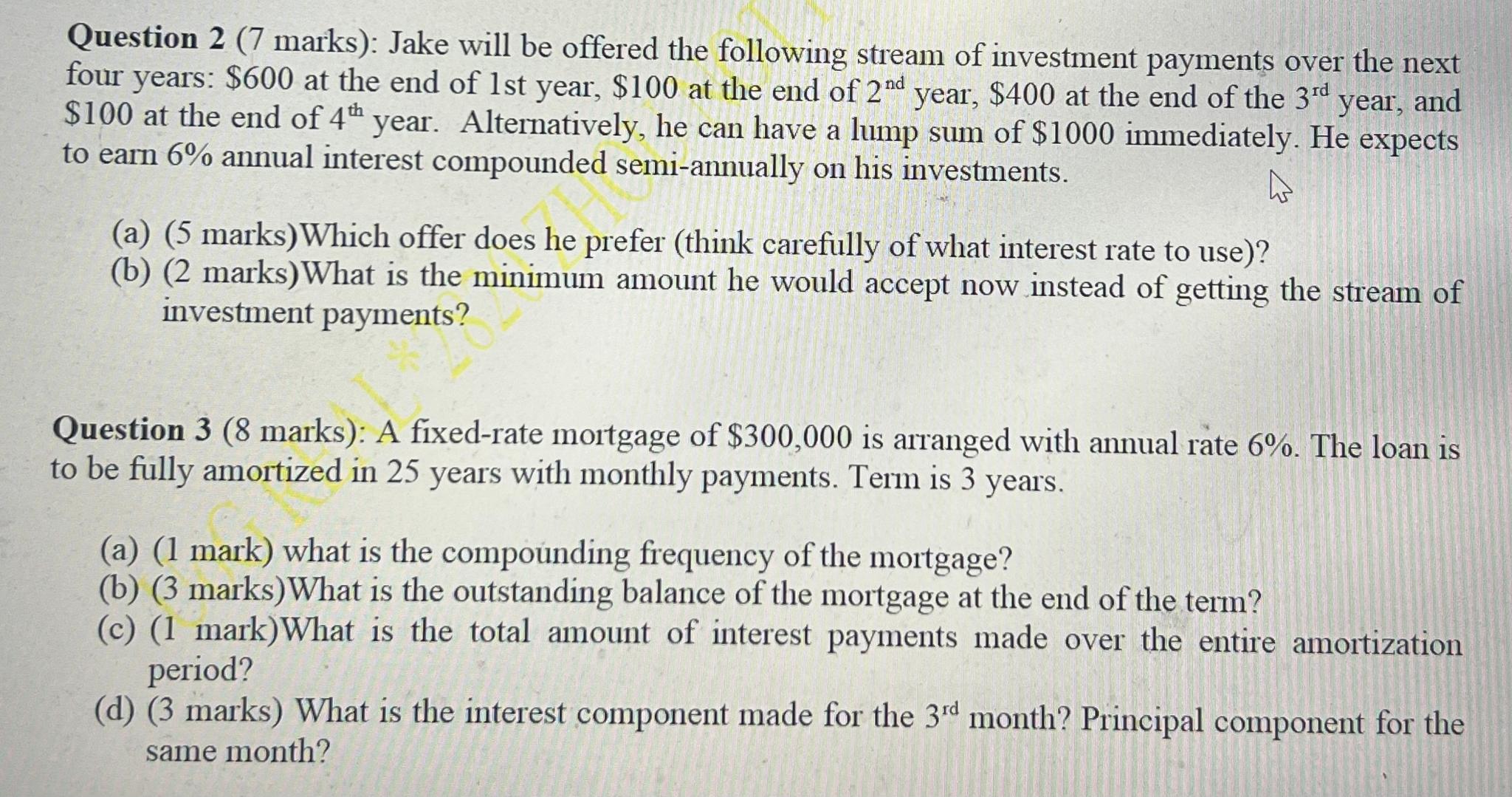

Question 2 (7 marks): Jake will be offered the following stream of investment payments over the next four years: $600 at the end of 1 st year, $100 at the end of 2nd year, $400 at the end of the 3rd year, and $100 at the end of 4th year. Alternatively, he can have a lump sum of $1000 immediately. He expects to earn 6% annual interest compounded semi-annually on his investments. (a) (5 marks)Which offer does he prefer (think carefully of what interest rate to use)? (b) (2 marks)What is the minimum amount he would accept now instead of getting the stream of investment payments? Question 3 (8 marks): A fixed-rate mortgage of $300,000 is arranged with annual rate 6%. The loan is to be fully amortized in 25 years with monthly payments. Term is 3 years. (a) (1 mark) what is the compounding frequency of the mortgage? (b) (3 marks)What is the outstanding balance of the mortgage at the end of the term? (c) (1 mark)What is the total amount of interest payments made over the entire amortization period? (d) (3 marks) What is the interest component made for the 3rd month? Principal component for the same month

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts