Question: Question 2 7 : On January 1 , 2 0 2 4 , Daniels Corporation, a Regular ( C ) Corporation converted to an S

Question :

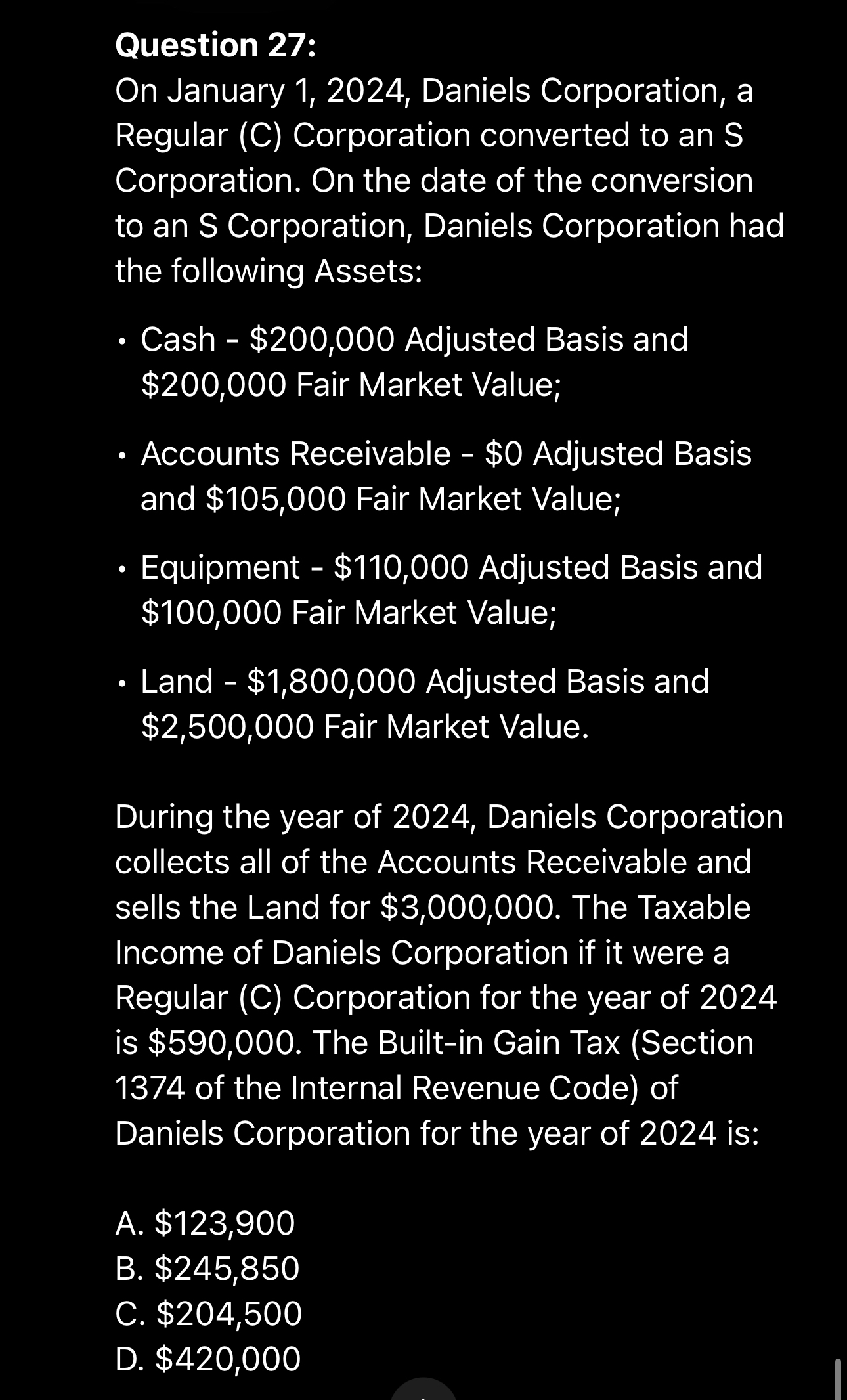

On January Daniels Corporation, a Regular C Corporation converted to an S Corporation. On the date of the conversion to an S Corporation, Daniels Corporation had the following Assets:

Cash $ Adjusted Basis and $ Fair Market Value;

Accounts Receivable $ Adjusted Basis and $ Fair Market Value;

Equipment $ Adjusted Basis and $ Fair Market Value;

Land $ Adjusted Basis and $ Fair Market Value.

During the year of Daniels Corporation collects all of the Accounts Receivable and sells the Land for $ The Taxable Income of Daniels Corporation if it were a Regular C Corporation for the year of is $ The Builtin Gain Tax Section of the Internal Revenue Code of Daniels Corporation for the year of is:

A $

B $

C $

D $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock