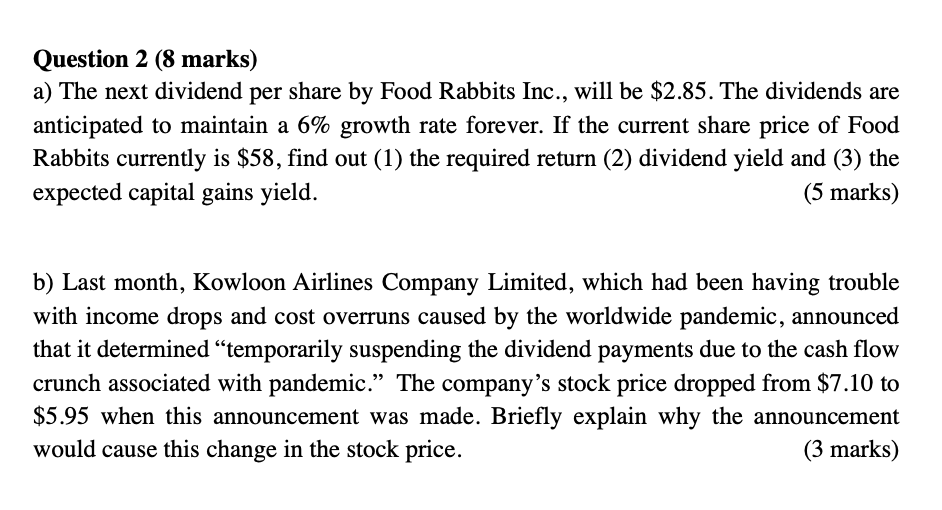

Question: Question 2 (8 marks) a) The next dividend per share by Food Rabbits Inc., will be $2.85. The dividends are anticipated to maintain a 6%

Question 2 (8 marks) a) The next dividend per share by Food Rabbits Inc., will be $2.85. The dividends are anticipated to maintain a 6% growth rate forever. If the current share price of Food Rabbits currently is $58, find out (1) the required return (2) dividend yield and (3) the expected capital gains yield. (5 marks) b) Last month, Kowloon Airlines Company Limited, which had been having trouble with income drops and cost overruns caused by the worldwide pandemic, announced that it determined temporarily suspending the dividend payments due to the cash flow crunch associated with pandemic. The company's stock price dropped from $7.10 to $5.95 when this announcement was made. Briefly explain why the announcement would cause this change in the stock price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts