Question: Question 2 - (8 marks) Digital Ltd is involved in the research and development of a new type of Robots used in manufacturing industry. For

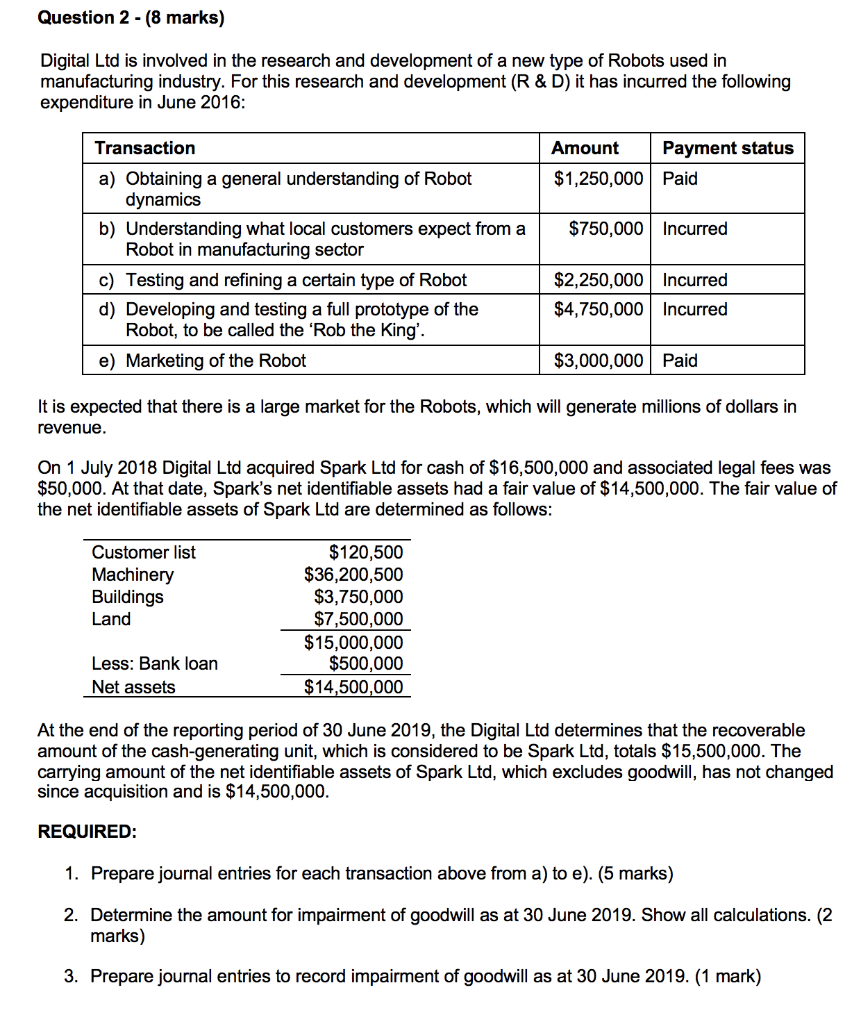

Question 2 - (8 marks) Digital Ltd is involved in the research and development of a new type of Robots used in manufacturing industry. For this research and development (R&D) it has incurred the following expenditure in June 2016: Amount $1,250,000 Payment status Paid $750,000 Incurred Transaction a) Obtaining a general understanding of Robot dynamics b) Understanding what local customers expect from a Robot in manufacturing sector c) Testing and refining a certain type of Robot d) Developing and testing a full prototype of the Robot, to be called the 'Rob the King'. e) Marketing of the Robot $2,250,000 Incurred $4,750,000 Incurred $3,000,000 Paid It is expected that there is a large market for the Robots, which will generate millions of dollars in revenue. On 1 July 2018 Digital Ltd acquired Spark Ltd for cash of $16,500,000 and associated legal fees was $50,000. At that date, Spark's net identifiable assets had a fair value of $14,500,000. The fair value of the net identifiable assets of Spark Ltd are determined as follows: Customer list Machinery Buildings Land $120,500 $36,200,500 $3,750,000 $7,500,000 $15,000,000 $500,000 $14,500,000 Less: Bank loan Net assets At the end of the reporting period of 30 June 2019, the Digital Ltd determines that the recoverable amount of the cash-generating unit, which is considered to be Spark Ltd, totals $15,500,000. The carrying amount of the net identifiable assets of Spark Ltd, which excludes goodwill, has not changed since acquisition and is $14,500,000. REQUIRED: 1. Prepare journal entries for each transaction above from a) to e). (5 marks) 2. Determine the amount for impairment of goodwill as at 30 June 2019. Show all calculations. (2 marks) 3. Prepare journal entries to record impairment of goodwill as at 30 June 2019. (1 mark) Question 2 - (8 marks) Digital Ltd is involved in the research and development of a new type of Robots used in manufacturing industry. For this research and development (R&D) it has incurred the following expenditure in June 2016: Amount $1,250,000 Payment status Paid $750,000 Incurred Transaction a) Obtaining a general understanding of Robot dynamics b) Understanding what local customers expect from a Robot in manufacturing sector c) Testing and refining a certain type of Robot d) Developing and testing a full prototype of the Robot, to be called the 'Rob the King'. e) Marketing of the Robot $2,250,000 Incurred $4,750,000 Incurred $3,000,000 Paid It is expected that there is a large market for the Robots, which will generate millions of dollars in revenue. On 1 July 2018 Digital Ltd acquired Spark Ltd for cash of $16,500,000 and associated legal fees was $50,000. At that date, Spark's net identifiable assets had a fair value of $14,500,000. The fair value of the net identifiable assets of Spark Ltd are determined as follows: Customer list Machinery Buildings Land $120,500 $36,200,500 $3,750,000 $7,500,000 $15,000,000 $500,000 $14,500,000 Less: Bank loan Net assets At the end of the reporting period of 30 June 2019, the Digital Ltd determines that the recoverable amount of the cash-generating unit, which is considered to be Spark Ltd, totals $15,500,000. The carrying amount of the net identifiable assets of Spark Ltd, which excludes goodwill, has not changed since acquisition and is $14,500,000. REQUIRED: 1. Prepare journal entries for each transaction above from a) to e). (5 marks) 2. Determine the amount for impairment of goodwill as at 30 June 2019. Show all calculations. (2 marks) 3. Prepare journal entries to record impairment of goodwill as at 30 June 2019. (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts