Question: QUESTION 2 (8 MARKS). This question has 2 parts; A and B. Write your answers in the spaces provided. A. Solar Ltd issued 10-year bonds

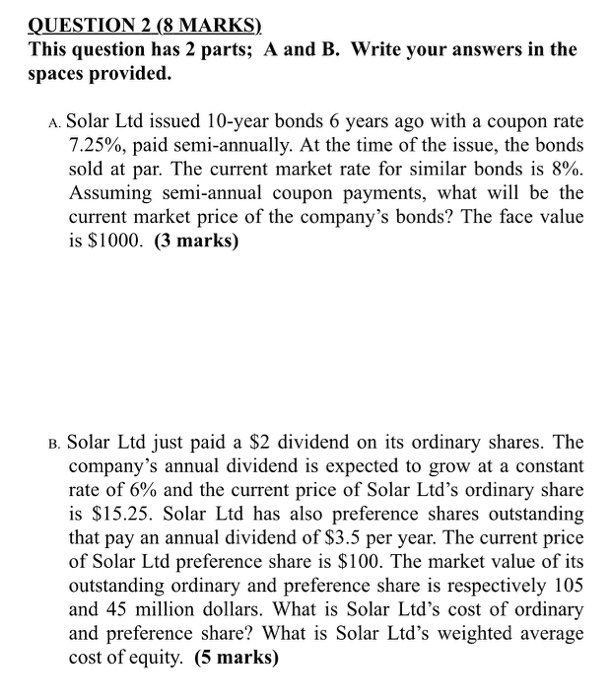

QUESTION 2 (8 MARKS). This question has 2 parts; A and B. Write your answers in the spaces provided. A. Solar Ltd issued 10-year bonds 6 years ago with a coupon rate 7.25%, paid semi-annually. At the time of the issue, the bonds sold at par. The current market rate for similar bonds is 8%. Assuming semi-annual coupon payments, what will be the current market price of the company's bonds? The face value is $1000. (3 marks) B. Solar Ltd just paid a $2 dividend on its ordinary shares. The company's annual dividend is expected to grow at a constant rate of 6% and the current price of Solar Ltd's ordinary share is $15.25. Solar Ltd has also preference shares outstanding that pay an annual dividend of $3.5 per year. The current price of Solar Ltd preference share is $100. The market value of its outstanding ordinary and preference share is respectively 105 and 45 million dollars. What is Solar Ltd's cost of ordinary and preference share? What is Solar Ltd's weighted average cost of equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts