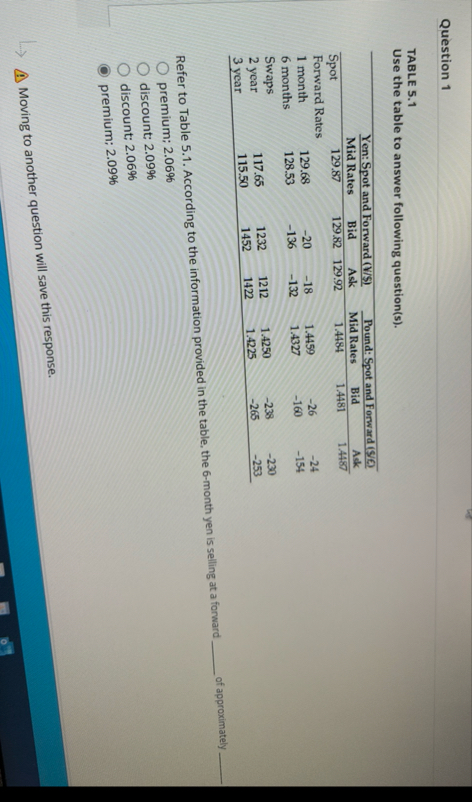

Question: Question 2 9 TABLE 5 . 1 Use the table to answer following question ( s ) . table [ [ , Yen: Spot

Question

TABLE

Use the table to answer following questions

tableYen: Spot and Forward #sPound: Spot and Forward SCMid Rates,Bid,Ask,Mid Rates,Bid,AskSpotForward Rates,,,,,, month, months,Swaps year, year,

Refer to Table The ask price for the twoyear swap for a British pound is:

$E

$E

$

$

Moving to another question will save this response.Moving to another question will save this response.

Question

TABLE

Use the table to answer following questions

tableYen: Spot and Forward sPound: Spot and Forward SQMid Rates,Bid,Ask,Mid Rates,Bid,AskSpotForward Rates,,,,,, month, months,Swaps year,

year,

Refer to Table According to the information provided in the table, the month yen is selling at a forward of approximately per annum.

premium;

discount:

discount;

premium;

Moving to another question will save this response.

Question

TABLE

Use the table to answer following questions

tableYen: Spot and Forward VSPound: Spot and Forward SEMid Rates,Bid,Ask,Mid Rates,Bid,AskSpotForward Rates,,,,,, month, months,Swaps year,

Refer to Table According to the information provided in the table, the month yen is selling at a forward of approximately

premium;

discount;

discount;

premium;

Moving to another question will save this response.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock