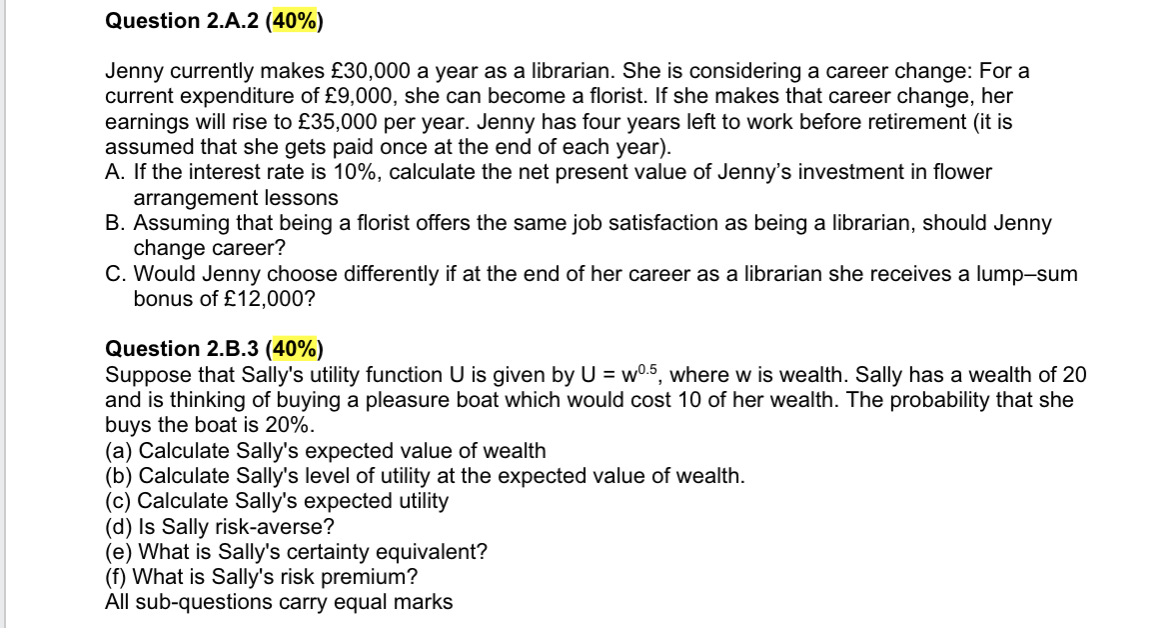

Question: Question 2 . A . 2 ( 4 0 % ) Jenny currently makes ( 3 0 , 0 0 0 )

Question A

Jenny currently makes a year as a librarian. She is considering a career change: For a current expenditure of she can become a florist. If she makes that career change, her earnings will rise to per year. Jenny has four years left to work before retirement it is assumed that she gets paid once at the end of each year

A If the interest rate is calculate the net present value of Jenny's investment in flower arrangement lessons

B Assuming that being a florist offers the same job satisfaction as being a librarian, should Jenny change career?

C Would Jenny choose differently if at the end of her career as a librarian she receives a lumpsum bonus of

Question B

Suppose that Sally's utility function U is given by Uw where w is wealth. Sally has a wealth of and is thinking of buying a pleasure boat which would cost of her wealth. The probability that she buys the boat is

a Calculate Sally's expected value of wealth

b Calculate Sally's level of utility at the expected value of wealth.

c Calculate Sally's expected utility

d Is Sally riskaverse?

e What is Sally's certainty equivalent?

f What is Sally's risk premium?

All subquestions carry equal marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock