Question: Question 2 a) A firm is considering the following mutually exclusive investment projects. Project Matahari requires an initial outlay of RM500,000 and will provide cash

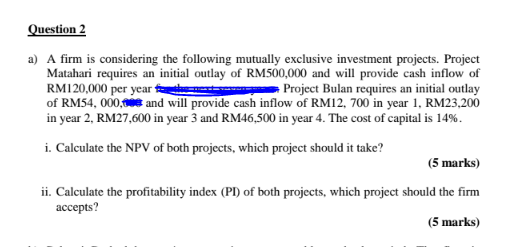

Question 2 a) A firm is considering the following mutually exclusive investment projects. Project Matahari requires an initial outlay of RM500,000 and will provide cash inflow of RM120,000 per year Project Bulan requires an initial outlay of RM54, 000, tee and will provide cash inflow of RM12, 700 in year 1, RM23,200 in year 2, RM27,600 in year 3 and RM46,500 in year 4. The cost of capital is 14%. i. Calculate the NPV of both projects, which project should it take? (5 marks) ii. Calculate the profitability index (PI) of both projects, which project should the firm accepts

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock