Question: QUESTION 2 a) Augustine Co. Ltd has the following information in its statement of financial position. GH '000 Ordinary shares of 50Gp 13% unsecured bonds

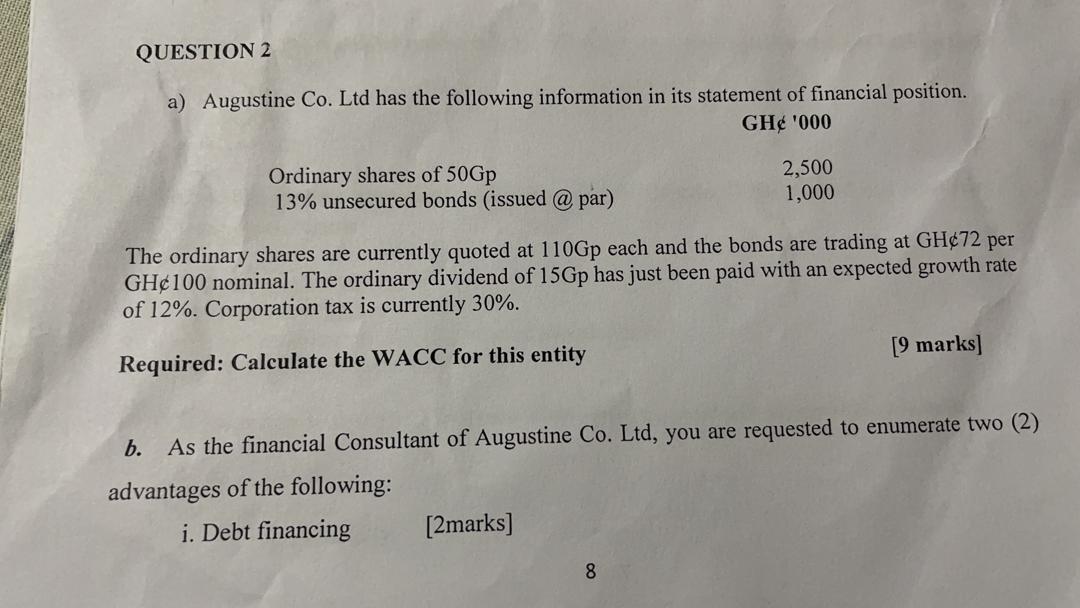

QUESTION 2 a) Augustine Co. Ltd has the following information in its statement of financial position. GH '000 Ordinary shares of 50Gp 13% unsecured bonds (issued @ par) 2,500 1,000 The ordinary shares are currently quoted at 110Gp each and the bonds are trading at GH72 per GH100 nominal. The ordinary dividend of 15Gp has just been paid with an expected growth rate of 12%. Corporation tax is currently 30%. [9 marks] Required: Calculate the WACC for this entity b. As the financial Consultant of Augustine Co. Ltd, you are requested to enumerate two (2) advantages of the following: i. Debt financing [2marks] 8 ii. Equity financing iii. Private Placement [2marks] [2 marks] [TOTAL: 15 marks] QUESTION 2 a) Augustine Co. Ltd has the following information in its statement of financial position. GH '000 Ordinary shares of 50Gp 13% unsecured bonds (issued @ par) 2,500 1,000 The ordinary shares are currently quoted at 110Gp each and the bonds are trading at GH72 per GH100 nominal. The ordinary dividend of 15Gp has just been paid with an expected growth rate of 12%. Corporation tax is currently 30%. [9 marks] Required: Calculate the WACC for this entity b. As the financial Consultant of Augustine Co. Ltd, you are requested to enumerate two (2) advantages of the following: i. Debt financing [2marks] 8 ii. Equity financing iii. Private Placement [2marks] [2 marks] [TOTAL: 15 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts