Question: Question 2 a. Calculate five different overhead absorption rates for cost centre 17 based on the following budgeted data: [5] Labour hours per period

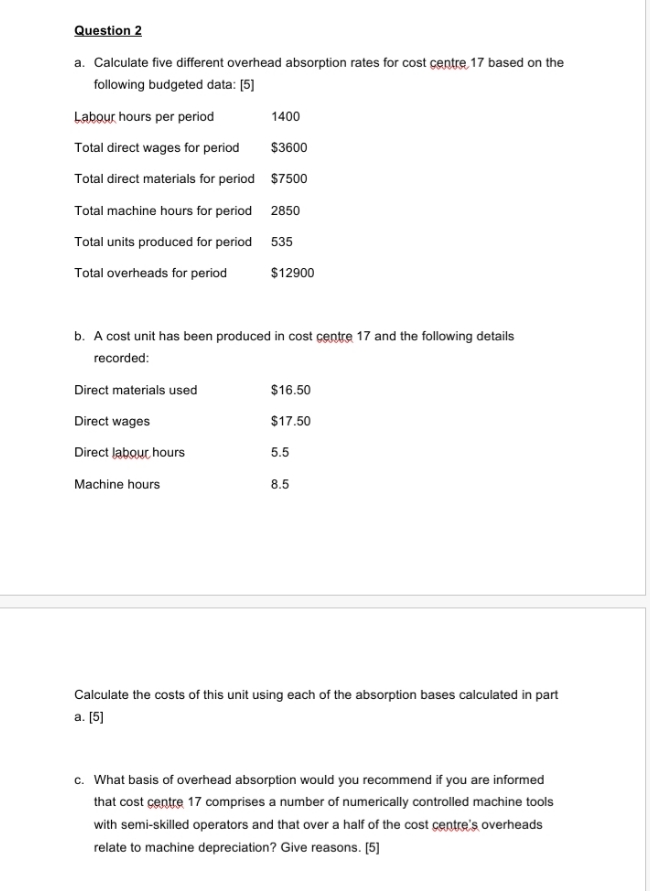

Question 2 a. Calculate five different overhead absorption rates for cost centre 17 based on the following budgeted data: [5] Labour hours per period 1400 Total direct wages for period $3600 Total direct materials for period $7500 Total machine hours for period 2850 Total units produced for period 535 Total overheads for period $12900 b. A cost unit has been produced in cost centre 17 and the following details recorded: Direct materials used $16.50 Direct wages $17.50 Direct labour hours 5.5 Machine hours 8.5 Calculate the costs of this unit using each of the absorption bases calculated in part a. [5] c. What basis of overhead absorption would you recommend if you are informed that cost centre 17 comprises a number of numerically controlled machine tools with semi-skilled operators and that over a half of the cost centre's overheads relate to machine depreciation? Give reasons. [5]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts