Question: Question 2 A . Clarke Enterprises' bonds currently sell for $ 1 , 1 8 0 , have an 1 1 % coupon interest rate

Question

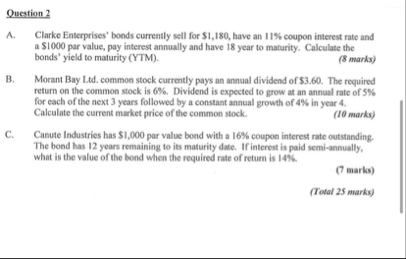

A Clarke Enterprises' bonds currently sell for $ have an coupon interest rate and a $ par value, pay interest annually and have year to maturity. Calculate the bonds' yield to maturity YTM

marks

B Morant Bay Ltd common stock currently pays an annual dividend of $ The required return on the common stock is Dividend is expected to grow at an annual rate of for each of the next years followed by a constant annual growth of in year Calculate the current merket price of the common stock.

marks

C Canute Industries has $ par value bond with a coupon interest rate outstanding. The bond has years remaining to its maturity date. If interest is paid semiannually, what is the value of the bond when the required rate of return is

marks

Total marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock