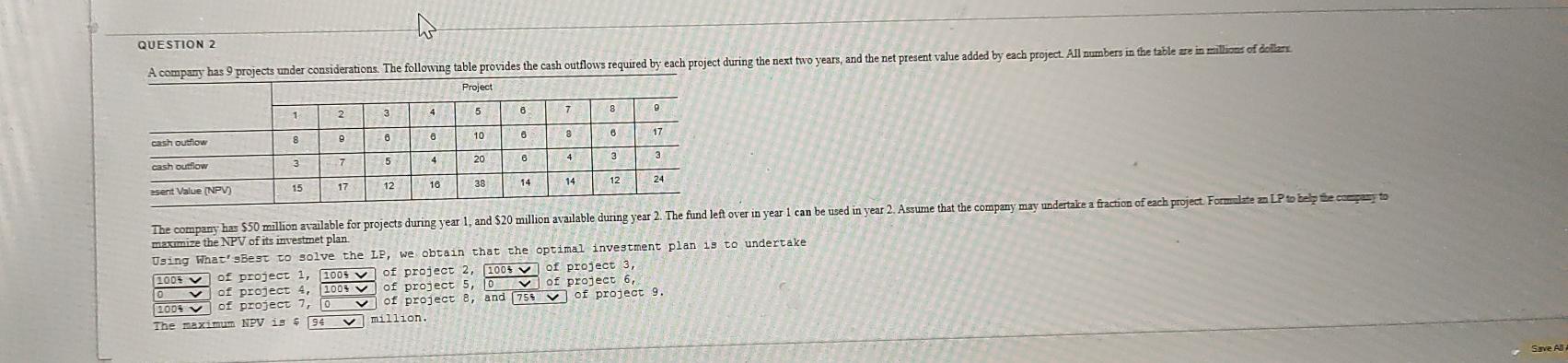

Question: QUESTION 2 A company has 9 projects under considerations. The following table provides the cash outflows required by each project during the next two years,

QUESTION 2 A company has 9 projects under considerations. The following table provides the cash outflows required by each project during the next two years, and the net present value added by each project. All numbers in the table ze in millions of dollar Project 3 4 5 6 1 7 8 9 6 0 10 17 8 6 8 cash outflow 3 4 7 4 6 3 3 5 20 cash outflow 14 38 14 16 12 24 15 17 12 sent Value (NPV) The company has $50 million available for projects during year 1, and $20 million available during year 2. The fund left over in year 1 can be used in year 2. Assume that the company may undertake a fraction of each project. Fole z beses maximize the NPV of its investmet plan Using What's Best to solve the LP, we obtain that the optimal investment plan 13 to undertake 2005 V of project 1, 1005 of project 2, 100% of project 3, of project 4, 1009 of project 5, D V of project 6, 1001 V of project 7, 0 of project 8, and (759 of project 9. The maximum NPV is $ 94 v million. Save

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock