Question: Question 2 A company is deciding constructing an office block. The cost of land and construction cost is estimated to be $700,000. The real estate

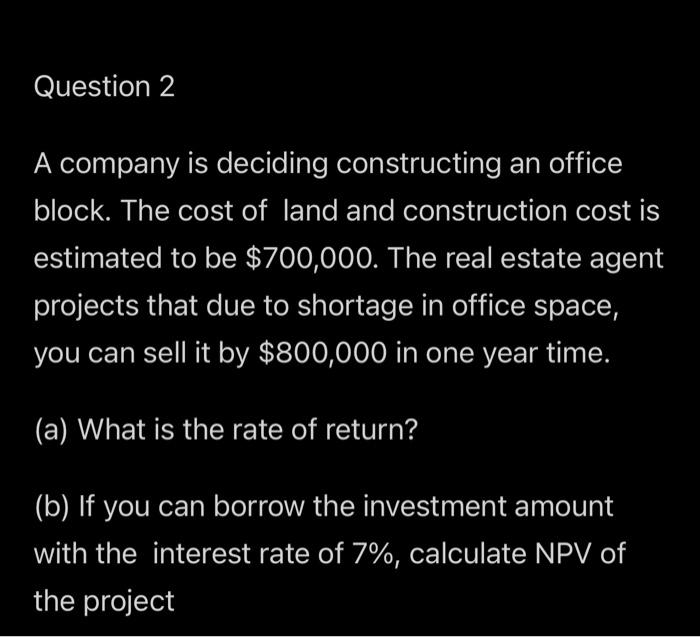

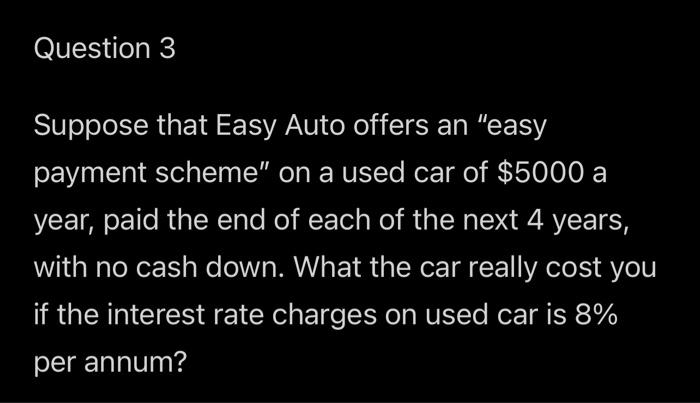

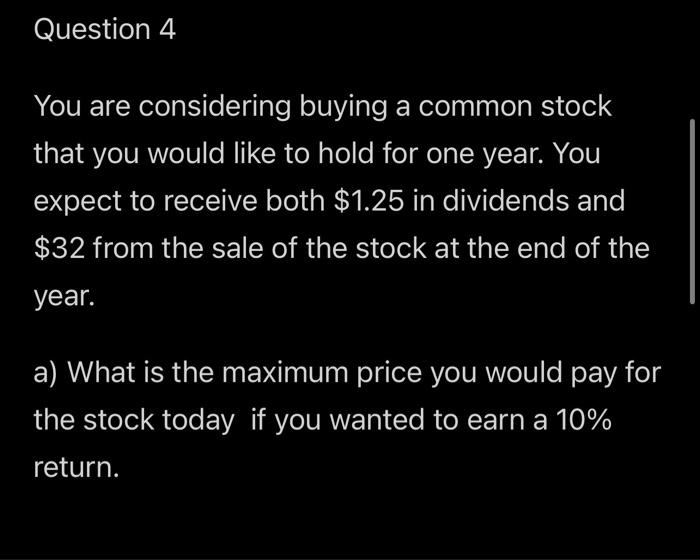

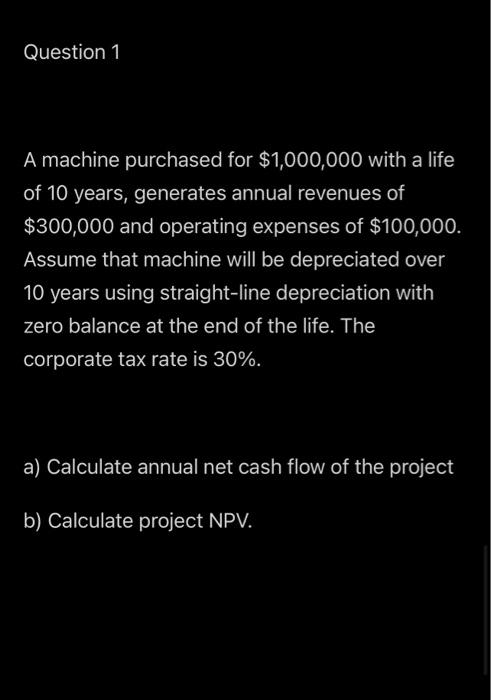

Question 2 A company is deciding constructing an office block. The cost of land and construction cost is estimated to be $700,000. The real estate agent projects that due to shortage in office space, you can sell it by $800,000 in one year time. (a) What is the rate of return? (b) If you can borrow the investment amount with the interest rate of 7%, calculate NPV of the project Question 3 Suppose that Easy Auto offers an "easy payment scheme" on a used car of $5000 a year, paid the end of each of the next 4 years, with no cash down. What the car really cost you if the interest rate charges on used car is 8% per annum? Question 4 You are considering buying a common stock that you would like to hold for one year. You expect to receive both $1.25 in dividends and $32 from the sale of the stock at the end of the year. a) What is the maximum price you would pay for the stock today if you wanted to earn a 10% return. Question 1. A machine purchased for $1,000,000 with a life of 10 years, generates annual revenues of $300,000 and operating expenses of $100,000. Assume that machine will be depreciated over 10 years using straight-line depreciation with zero balance at the end of the life. The corporate tax rate is 30%. a) Calculate annual net cash flow of the project b) Calculate project NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts