Question: QUESTION 2 a. Compare the assumptions underlying the Capital Asset Pricing Model and arbitrage pricing models. [10 marks] b. An analyst is interested in testing

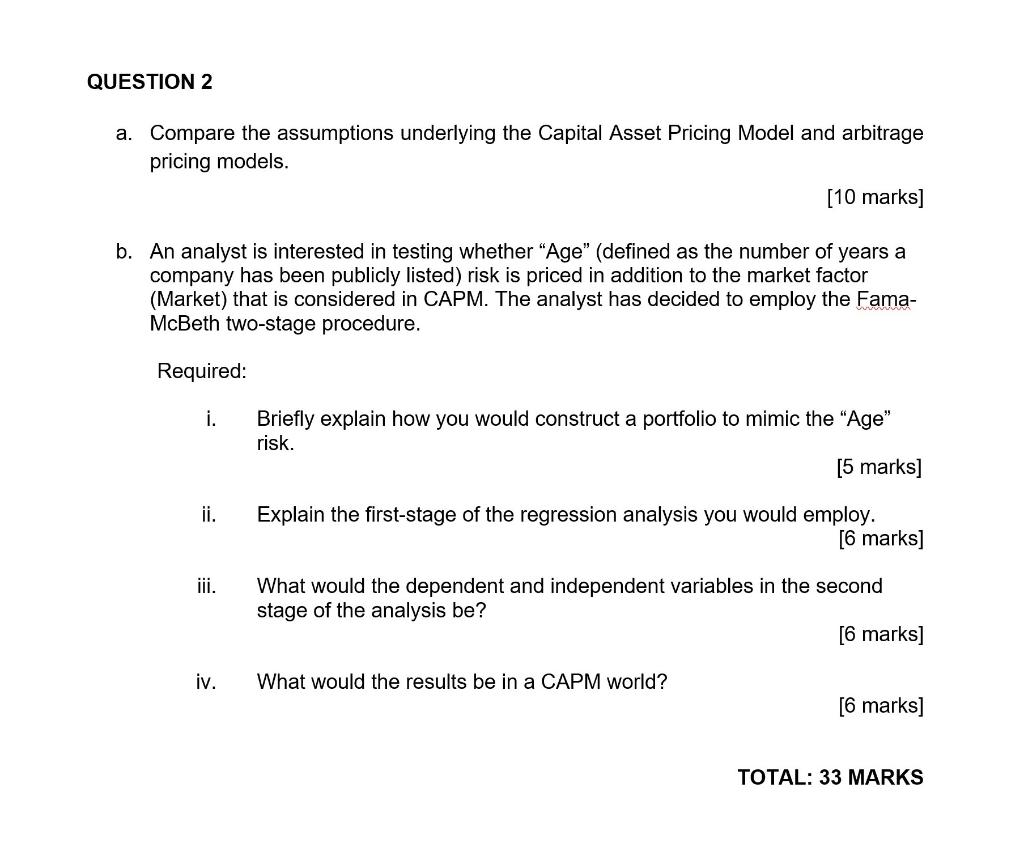

QUESTION 2 a. Compare the assumptions underlying the Capital Asset Pricing Model and arbitrage pricing models. [10 marks] b. An analyst is interested in testing whether "Age" (defined as the number of years a company has been publicly listed) risk is priced in addition to the market factor (Market) that is considered in CAPM. The analyst has decided to employ the Fama- McBeth two-stage procedure. Required: i. Briefly explain how you would construct a portfolio to mimic the "Age" risk. [5 marks] ii. Explain the first-stage of the regression analysis you would employ. [6 marks] iii. What would the dependent and independent variables in the second stage of the analysis be? [6 marks] iv. What would the results be in a CAPM world? [6 marks] TOTAL: 33 MARKS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts