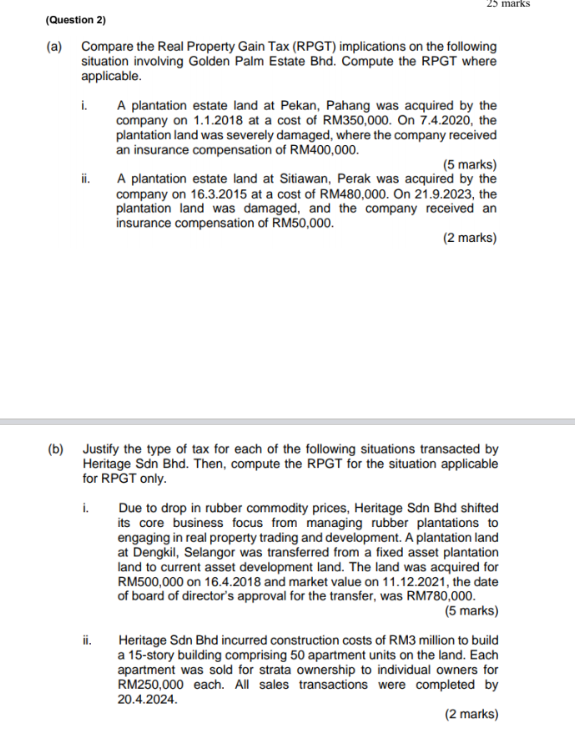

Question: ( Question 2 ) ( a ) Compare the Real Property Gain Tax ( RPGT ) implications on the following situation involving Golden Palm Estate

Question a Compare the Real Property Gain Tax RPGT implications on the following situation involving Golden Palm Estate Bhd Compute the RPGT where applicable. i A plantation estate land at Pekan, Pahang was acquired by the company on at a cost of RM On the plantation land was severely damaged, where the company received an insurance compensation of RM marks ii A plantation estate land at Sitiawan, Perak was acquired by the company on at a cost of RM On the plantation land was damaged, and the company received an insurance compensation of RM marksb Justify the type of tax for each of the following situations transacted by Heritage Sdn Bhd Then, compute the RPGT for the situation applicable for RPGT only. i Due to drop in rubber commodity prices, Heritage Sdn Bhd shifted its core business focus from managing rubber plantations to engaging in real property trading and development. A plantation land at Dengkil, Selangor was transferred from a fixed asset plantation land to current asset development land. The land was acquired for RM on and market value on the date of board of director's approval for the transfer, was RM ii Heritage Sdn Bhd incurred construction costs of RM million to build a story building comprising apartment units on the land. Each apartment was sold for strata ownership to individual owners for RM each. All sales transactions were completed by c Alex is a Malaysian citizen and Jezmyn is a Malaysian noncitizen. They are a married couple who coown a story building in Kuala Lumpur. The first floor is used for their restaurant business and the second floor is used as the restaurant staff hostel.

The property was acquired on for RM Subsequently, on the building was sold for RM million.

Required:

i Identify the conditions to claim the RPGT exemption once in a lifetime.

marks

ii Compute the RPGT applicable to Alex and Jezmyn for the above disposal. Consider that Alex is entitled for RPGT exemption once in a lifetime and the buiding is equally valued by the respective floors.

marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock