Question: Question 2 a) Data for company X and Y are given below. The T-bill rate is 3.5% and the market risk premium is 8% Company

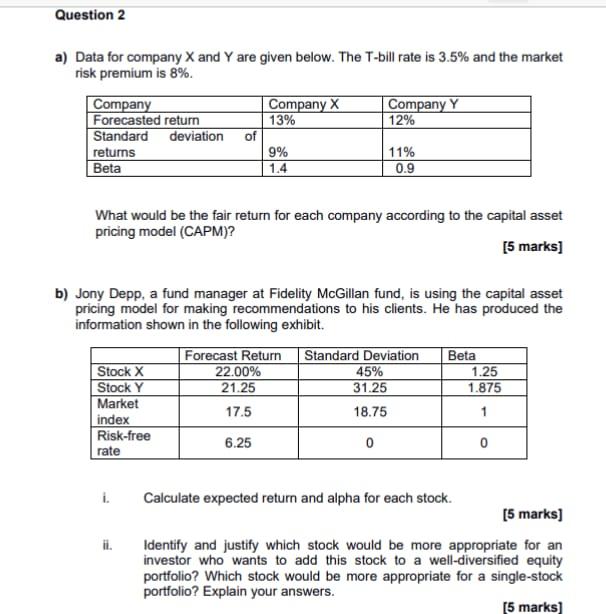

Question 2 a) Data for company X and Y are given below. The T-bill rate is 3.5% and the market risk premium is 8% Company Company X Company Y Forecasted return 13% 12% Standard deviation of returns 9% 11% Beta 1.4 0.9 What would be the fair return for each company according to the capital asset pricing model (CAPM)? [5 marks] b) Jony Depp, a fund manager at Fidelity McGillan fund, is using the capital asset pricing model for making recommendations to his clients. He has produced the information shown in the following exhibit Forecast Return Standard Deviation Beta Stock X 22.00% 45% 1.25 Stock Y 21.25 31.25 1.875 Market 17.5 18.75 index Risk-free 6.25 0 0 rate 1 i. Calculate expected return and alpha for each stock. [5 marks) Identify and justify which stock would be more appropriate for an investor who wants to add this stock to a well-diversified equity portfolio? Which stock would be more appropriate for a single-stock portfolio? Explain your answers. (5 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts