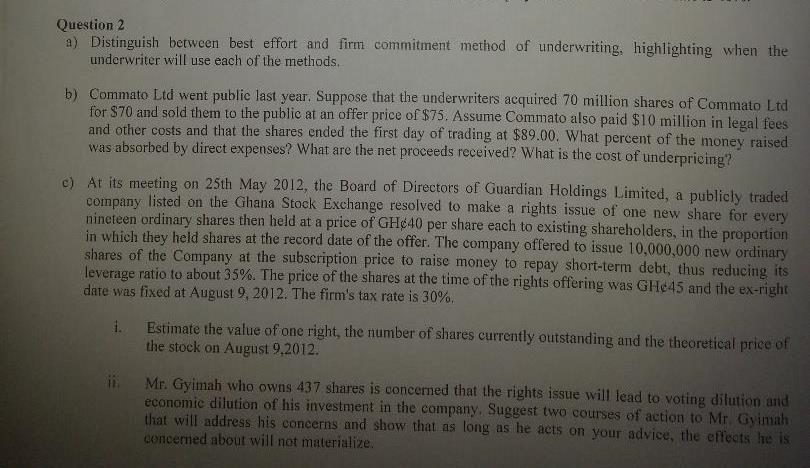

Question: Question 2 a) Distinguish between best effort and firm commitment method of underwriting, highlighting when the underwriter will use each of the methods Commato Ltd

Question 2 a) Distinguish between best effort and firm commitment method of underwriting, highlighting when the underwriter will use each of the methods Commato Ltd went publie last year. Suppose that the underwriters acquired 70 million shares of Commato for $70 and sold them to the public at an offer price of S and other costs and that the shares ended the first day of trading at $89.00. What percent of the mone was absorbed by direct expenses? What are the net proceeds received? What is the cost of underp b) 75. Assume Commato also paid $10 million in legal fees meeting on 25th May 2012, the Board of Directors of Guardian Holdings Limited, a publicly traded shareholders, in the proportion e rights offering was GHe45 and the ex-right Estimate the value of one right, the number of shares currently outstanding and the theoretical price of c) At its company listed on the Ghana Stock Exchange resolved to make a rights issue of one new share for e nineteen ordinary shares then held at a price of GHc40 per share each to existing in which they held shares at the record date of the offer. The company offered to issue 10.000,000 new ordinary shares of the Company at the subscription price to raise money to repay short-term debt, thus reducing its leverage ratio to about 35%. The price of the shares at the time of t date was fixed at August 9, 2012, The firm's tax rate is 30% i. the stock on August 9,2012. i Mr. Gyimah who owns 437 shares is concerned that the rights issue will lead to voting dilution and economie dilution of his investment in the company. Suggest two courses of action to Mr. Gyimah that will address his concerns and show that as long as he acis on your advice, the effets h concerned about will not materialize

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts