Question: QUESTION 2 A. E&E Repairs is trying to decide whether it should relax its credit standards. The firm repairs 60,000 carpets per year at an

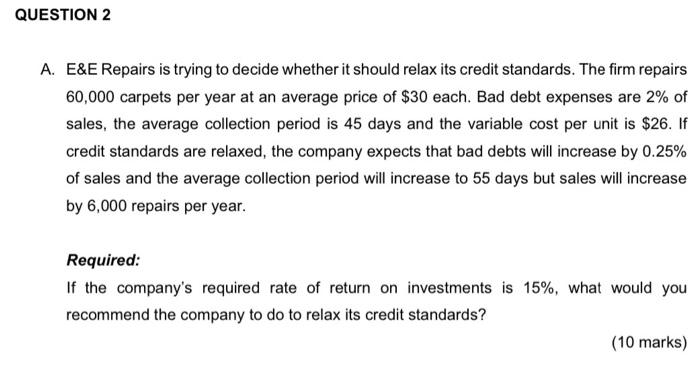

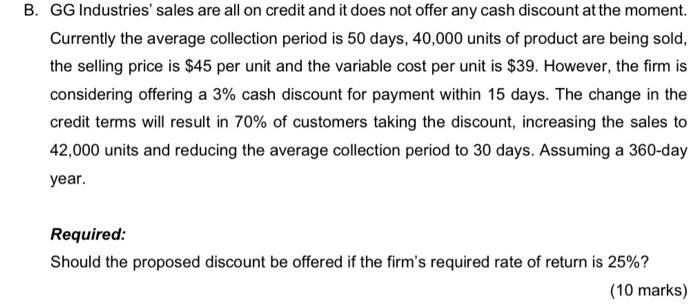

QUESTION 2 A. E&E Repairs is trying to decide whether it should relax its credit standards. The firm repairs 60,000 carpets per year at an average price of $30 each. Bad debt expenses are 2% of sales, the average collection period is 45 days and the variable cost per unit is $26. If credit standards are relaxed, the company expects that bad debts will increase by 0.25% of sales and the average collection period will increase to 55 days but sales will increase by 6,000 repairs per year. Required: If the company's required rate of return on investments is 15%, what would you recommend the company to do to relax its credit standards? (10 marks) B. GG Industries' sales are all on credit and it does not offer any cash discount at the moment. Currently the average collection period is 50 days, 40,000 units of product are being sold, the selling price is $45 per unit and the variable cost per unit is $39. However, the firm is considering offering a 3% cash discount for payment within 15 days. The change in the credit terms will result in 70% of customers taking the discount, increasing the sales to 42,000 units and reducing the average collection period to 30 days. Assuming a 360-day year. Required: Should the proposed discount be offered if the firm's required rate of return is 25%? (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts