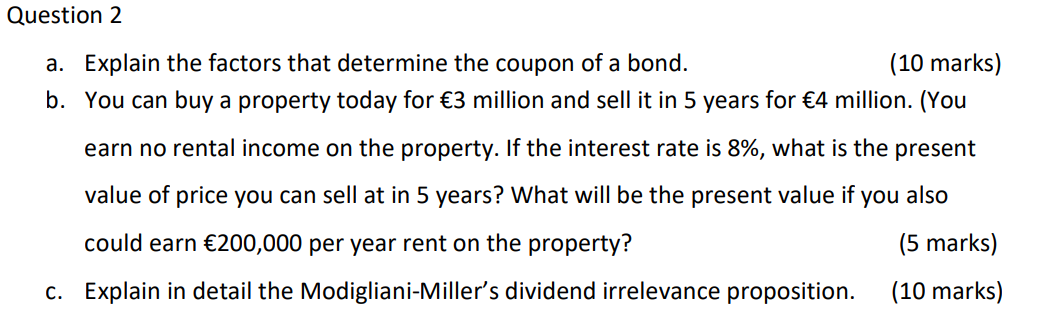

Question: Question 2 a . Explain the factors that determine the coupon of a bond. b . You can buy a property today for 3 million

Question

a Explain the factors that determine the coupon of a bond.

b You can buy a property today for million and sell it in years for million. You

earn no rental income on the property. If the interest rate is what is the present

value of price you can sell at in years? What will be the present value if you also

could earn per year rent on the property?

c Explain in detail the ModiglianiMiller's dividend irrelevance proposition.Explain the factors that determine the coupon of a bond. marks

b You can buy a property today for million and sell it in years for million. You

earn no rental income on the property. If the interest rate is what is the present

value of price you can sell at in years? What will be the present value if you also

could earn per year rent on the property? marks

c Explain in detail the ModiglianiMillers dividend irrelevance proposition

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock