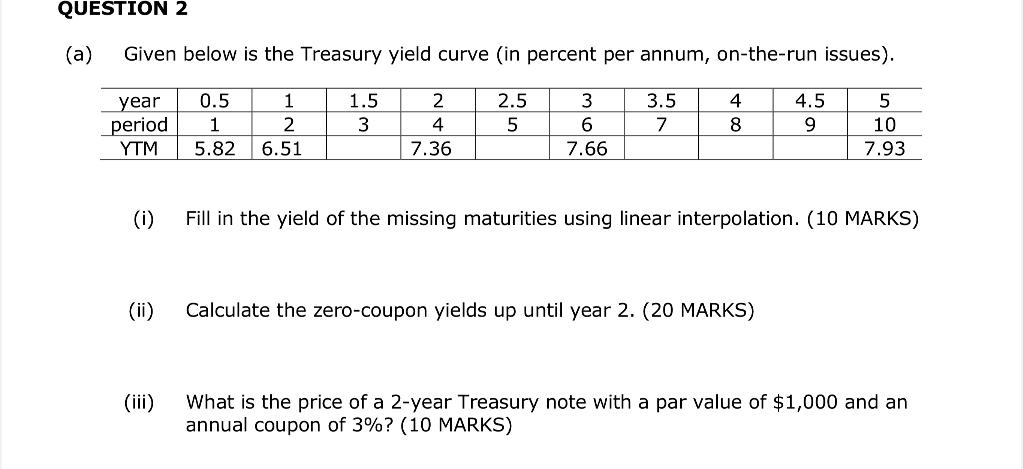

Question: QUESTION 2 (a) Given below is the Treasury yield curve (in percent per annum, on-the-run issues). year 0.5 1.5 2 2.5 3 3.5 4 4.5

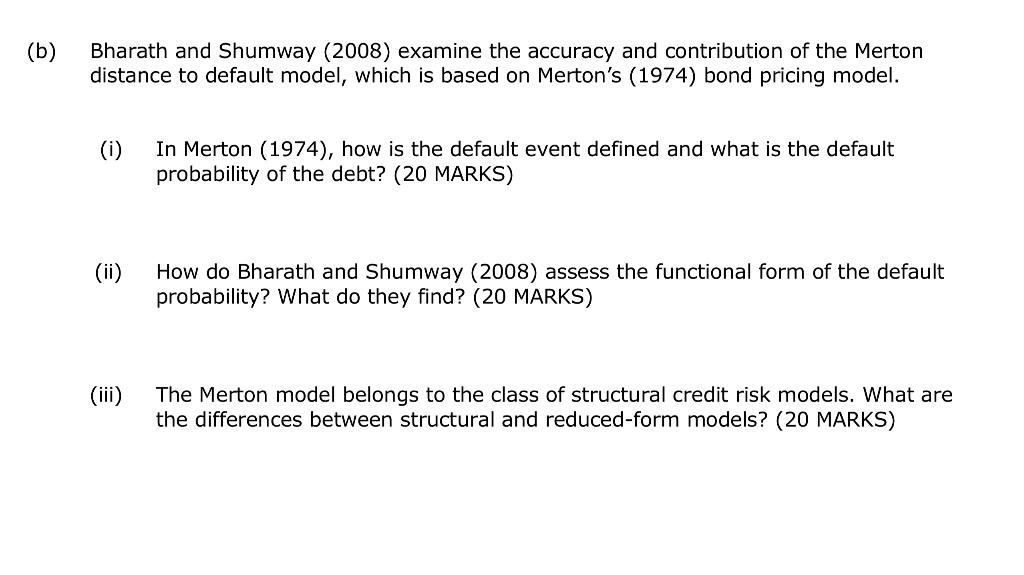

QUESTION 2 (a) Given below is the Treasury yield curve (in percent per annum, on-the-run issues). year 0.5 1.5 2 2.5 3 3.5 4 4.5 5 1 2 period 3 4 5 6 7 8 9 10 1 5.82 6.51 YTM 7.36 7.66 7.93 (i) Fill in the yield of the missing maturities using linear interpolation. (10 MARKS) (ii) Calculate the zero-coupon yields up until year 2. (20 MARKS) (iii) What is the price of a 2-year Treasury note with a par value of $1,000 and an annual coupon of 3%? (10 MARKS) (b) Bharath and Shumway (2008) examine the accuracy and contribution of the Merton distance to default model, which is based on Merton's (1974) bond pricing model. (i) In Merton (1974), how is the default event defined and what is the default probability of the debt? (20 MARKS) (ii) How do Bharath and Shumway (2008) assess the functional form of the default probability? What do they find? (20 MARKS) (iii) The Merton model belongs to the class of structural credit risk models. What are the differences between structural and reduced-form models? (20 MARKS) QUESTION 2 (a) Given below is the Treasury yield curve (in percent per annum, on-the-run issues). year 0.5 1.5 2 2.5 3 3.5 4 4.5 5 1 2 period 3 4 5 6 7 8 9 10 1 5.82 6.51 YTM 7.36 7.66 7.93 (i) Fill in the yield of the missing maturities using linear interpolation. (10 MARKS) (ii) Calculate the zero-coupon yields up until year 2. (20 MARKS) (iii) What is the price of a 2-year Treasury note with a par value of $1,000 and an annual coupon of 3%? (10 MARKS) (b) Bharath and Shumway (2008) examine the accuracy and contribution of the Merton distance to default model, which is based on Merton's (1974) bond pricing model. (i) In Merton (1974), how is the default event defined and what is the default probability of the debt? (20 MARKS) (ii) How do Bharath and Shumway (2008) assess the functional form of the default probability? What do they find? (20 MARKS) (iii) The Merton model belongs to the class of structural credit risk models. What are the differences between structural and reduced-form models? (20 MARKS)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts