Question: (Question 2) (a) Hovid Berhad is evaluating two common shares for the firm's new investment. Given below the information of the shares. Thelmin paid a

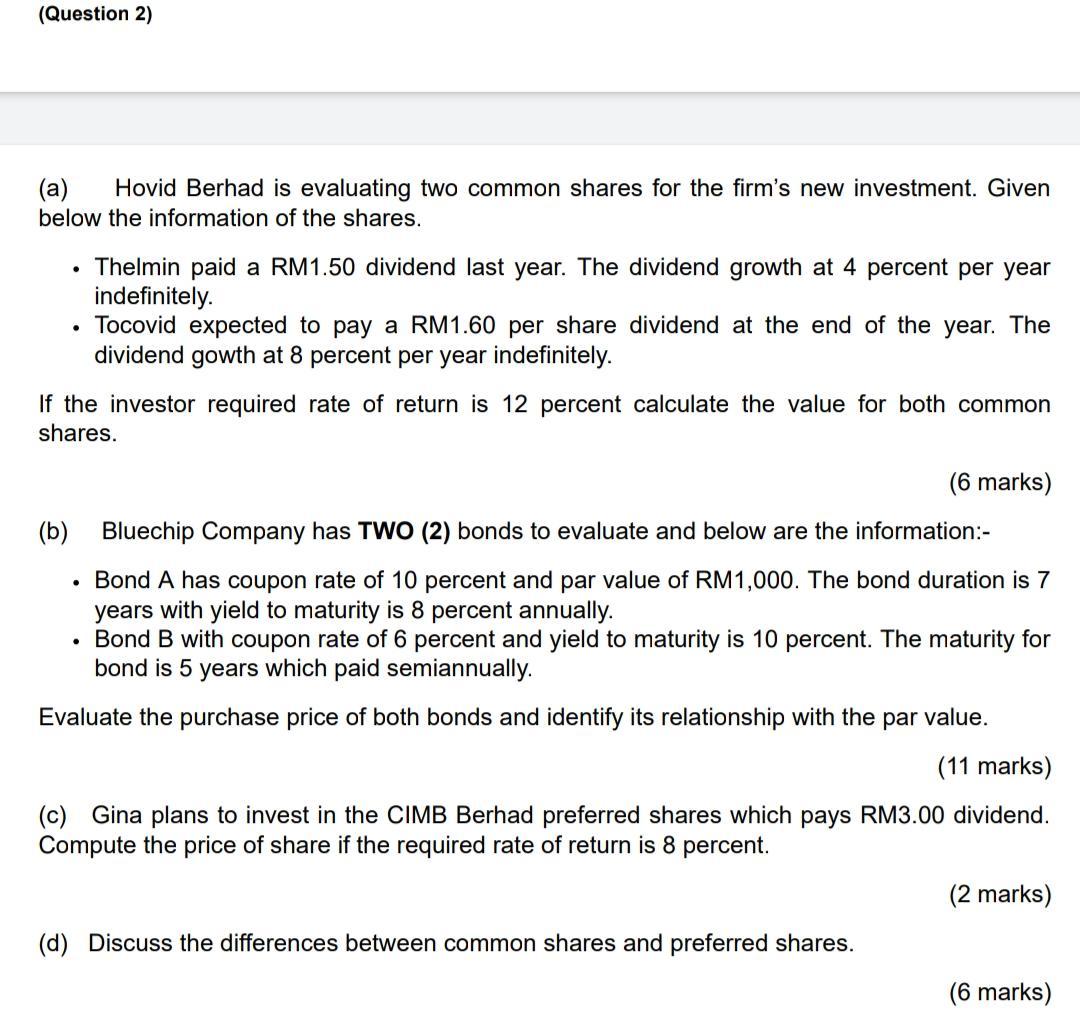

(Question 2) (a) Hovid Berhad is evaluating two common shares for the firm's new investment. Given below the information of the shares. Thelmin paid a RM1.50 dividend last year. The dividend growth at 4 percent per year indefinitely. Tocovid expected to pay a RM1.60 per share dividend at the end of the year. The dividend gowth at 8 percent per year indefinitely. If the investor required rate of return is 12 percent calculate the value for both common shares. (6 marks) (b) Bluechip Company has TWO (2) bonds to evaluate and below are the information:- Bond A has coupon rate of 10 percent and par value of RM1,000. The bond duration is 7 years with yield to maturity is 8 percent annually. Bond B with coupon rate of 6 percent and yield to maturity is 10 percent. The maturity for bond is 5 years which paid semiannually. Evaluate the purchase price of both bonds and identify its relationship with the par value. (11 marks) (c) Gina plans to invest in the CIMB Berhad preferred shares which pays RM3.00 dividend. Compute the price of share if the required rate of return is 8 percent. (2 marks) (d) Discuss the differences between common shares and preferred shares. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts