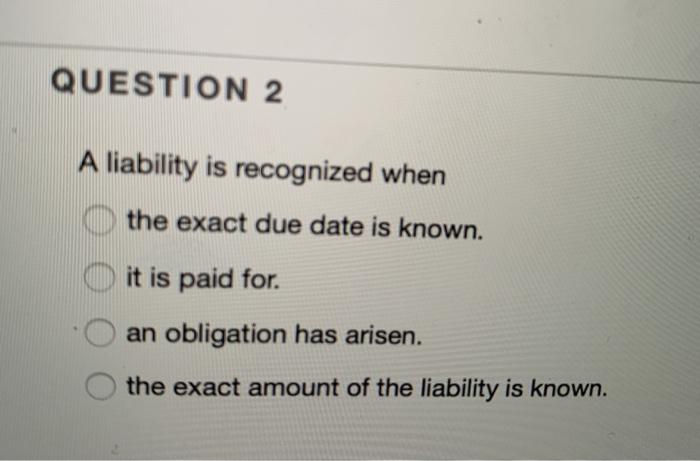

Question: QUESTION 2 A liability is recognized when the exact due date is known. it is paid for. an obligation has arisen. the exact amount of

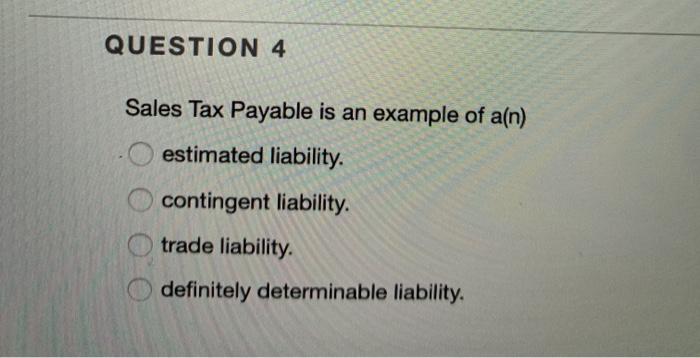

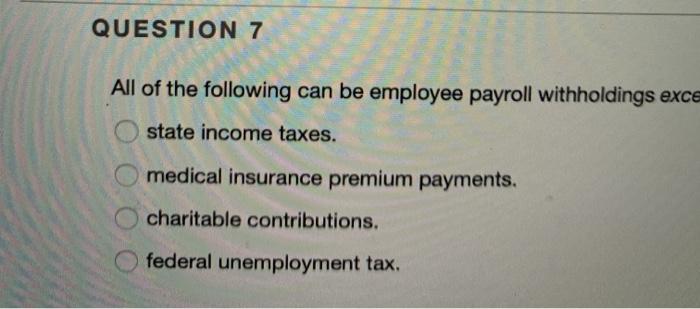

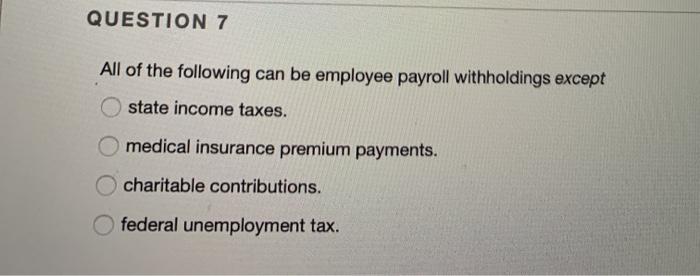

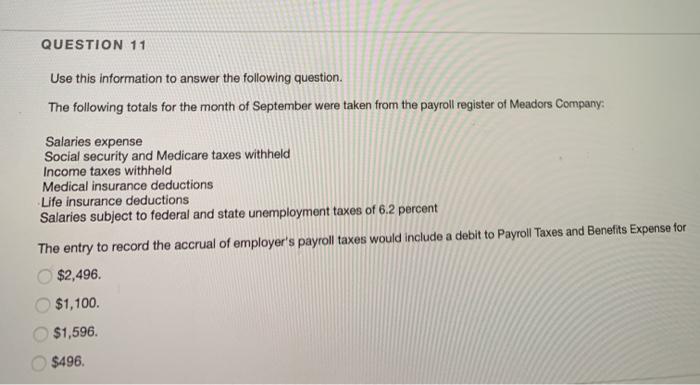

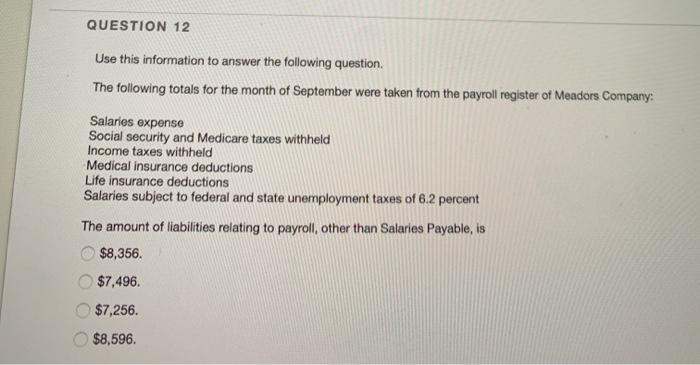

QUESTION 2 A liability is recognized when the exact due date is known. it is paid for. an obligation has arisen. the exact amount of the liability is known. QUESTION 4 Sales Tax Payable is an example of a(n) estimated liability. contingent liability. trade liability definitely determinable liability. QUESTION 7 All of the following can be employee payroll withholdings exce state income taxes. medical insurance premium payments. charitable contributions. federal unemployment tax. QUESTION 7 All of the following can be employee payroll withholdings except state income taxes. O medical insurance premium payments. charitable contributions. federal unemployment tax. QUESTION 11 Use this information to answer the following question. The following totals for the month of September were taken from the payroll register of Meadors Company: Salaries expense Social security and Medicare taxes withheld Income taxes withheld Medical insurance deductions Life insurance deductions Salaries subject to federal and state unemployment taxes of 6.2 percent The entry to record the accrual of employer's payroll taxes would include a debit to Payroll Taxes and Benefits Expense for $2,496 $1,100. $1,596. $496 QUESTION 12 Use this information to answer the following question. The following totals for the month of September were taken from the payroll register of Meadors Company: Salaries expense Social security and Medicare taxes withheld Income taxes withheld Medical insurance deductions Life insurance deductions Salaries subject to federal and state unemployment taxes of 6.2 percent The amount of liabilities relating to payroll, other than Salaries Payable, is $8,356. $7,496 $7.256. $8,596

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts