Question: QUESTION 2 a) Mac Ltd is a UK-based company. It has to pay 70 million euros in 180-days to its suppliers in France. The

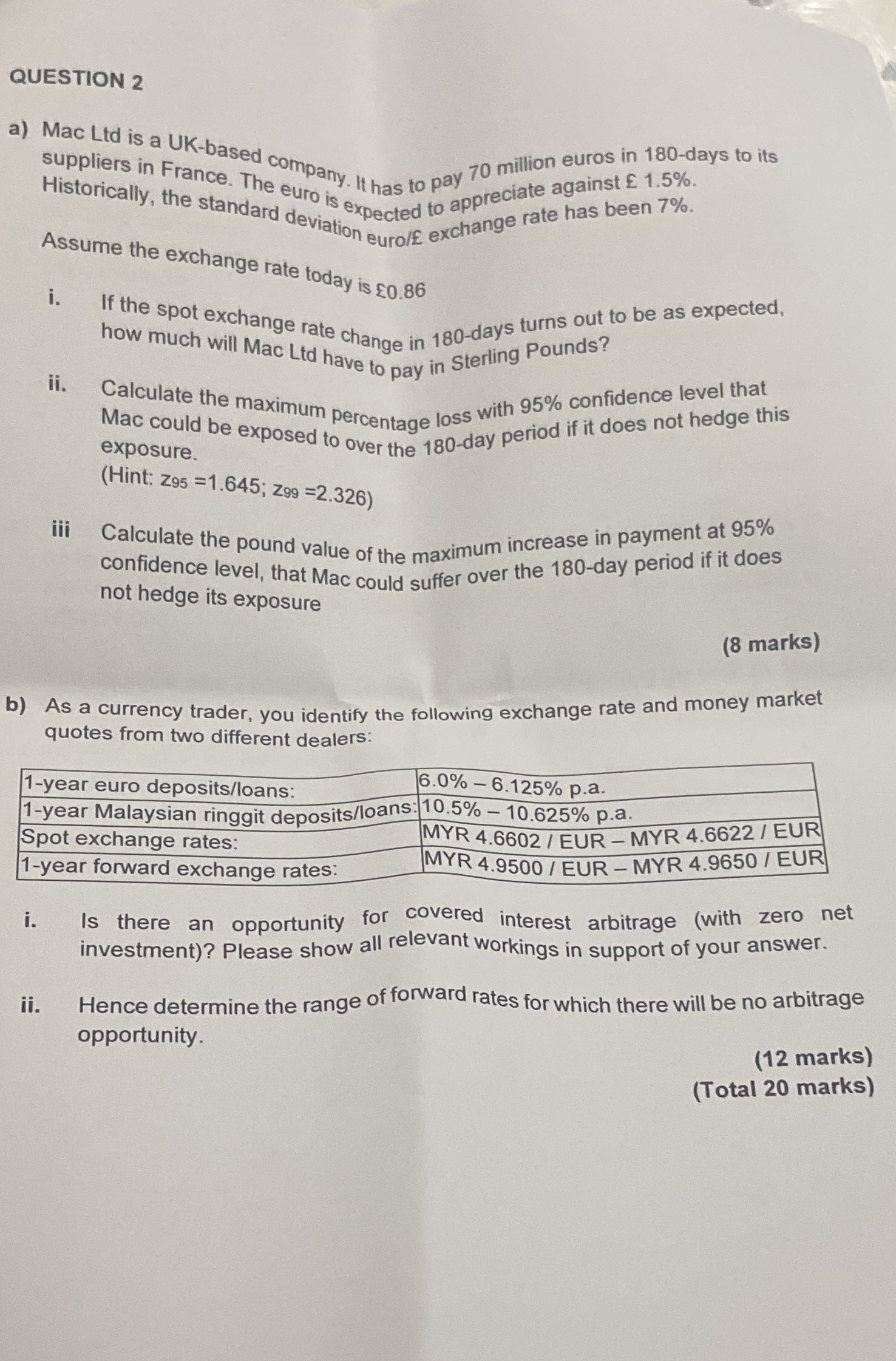

QUESTION 2 a) Mac Ltd is a UK-based company. It has to pay 70 million euros in 180-days to its suppliers in France. The euro is expected to appreciate against 1.5%. Historically, the standard deviation euro/ exchange rate has been 7%. Assume the exchange rate today is 0.86 i. ii. iii If the spot exchange rate change how much will Mac Ltd have to pay in Sterling Pounds? e in 180-days turns out to be as expected, Calculate the maximum percentage loss with 95% confidence level that Mac could be exposed to over the 180-day period if it does not hedge this exposure. (Hint: Z95 =1.645; Z99 =2.326) Calculate the pound value of the maximum increase in payment at 95% confidence level, that Mac could suffer over the 180-day period if it does not hedge its exposure (8 marks) b) As a currency trader, you identify the following exchange rate and money market quotes from two different dealers: 1-year euro deposits/loans: 6.0%-6.125% p.a. 1-year Malaysian ringgit deposits/loans: 10.5% -10.625% p.a. Spot exchange rates: 1-year forward exchange rates: MYR 4.6602 / EUR - MYR 4.6622/EUR MYR 4.9500/EUR - MYR 4.9650 / EUR i. Is there an opportunity for covered interest arbitrage (with zero net investment)? Please show all relevant workings in support of your answer. ii. Hence determine the range of forward rates for which there will be no arbitrage opportunity. (12 marks) (Total 20 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts