Question: QUESTION 2 A machine with a four-year estimated useful life and an estimated residual value of $10,000 was acquired on January 1, 2011 for $40,000.

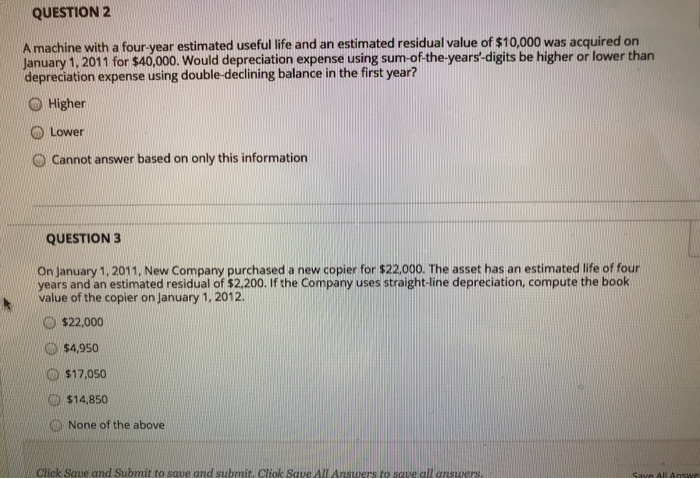

QUESTION 2 A machine with a four-year estimated useful life and an estimated residual value of $10,000 was acquired on January 1, 2011 for $40,000. Would depreciation expense using sum-of-the-years-digits be higher or lower than depreciation expense using double-declining balance in the first year? Higher Lower Cannot answer based on only this information QUESTION 3 On January 1, 2011, New Company purchased a new copier for $22.000. The asset has an estimated life of four years and an estimated residual of $2,200. If the Company uses straight-line depreciation, compute the book value of the copier on January 1, 2012 $22,000 $4,950 $17,050 $14,850 None of the above Click Save and Submit to save and submit. Cliok Save All Answers to save all answers. Save All Answe

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts