Question: Question #2 A non-callable bond with 192 months remaining maturity has a semi-annual coupon of 5.5% and a $1,000 par value. The yield to maturity

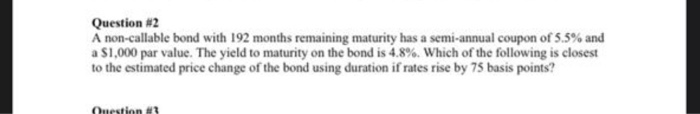

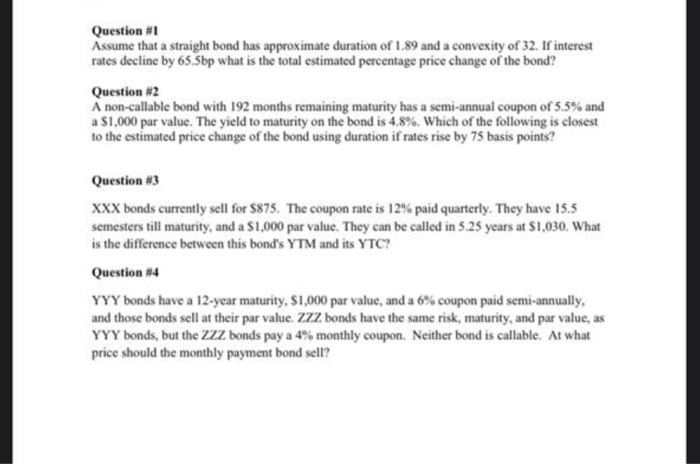

Question #2 A non-callable bond with 192 months remaining maturity has a semi-annual coupon of 5.5% and a $1,000 par value. The yield to maturity on the bond is 4.8%. Which of the following is closest to the estimated price change of the bond using duration if rates rise by 75 basis points? Question 3 Question #1 Assume that a straight bond has approximate duration of 1.89 and a convexity of 32. If interest rates decline by 65.Sbp what is the total estimated percentage price change of the bond? Question #2 A non-callable bond with 192 months remaining maturity has a semi-annual coupon of 5.5% and a $1,000 par value. The yield to maturity on the bond is 4.8%. Which of the following is closest to the estimated price change of the bond using duration if rates rise by 75 basis points? Question #3 XXX bonds currently sell for $875. The coupon rate is 12% paid quarterly. They have 15.5 semesters till maturity, and a $1,000 par value. They can be called in 5.25 years at $1.030. What is the difference between this bond's YTM and its YTC? Question #14 YYY bonds have a 12-year maturity, S1,000 par value, and a 6% coupon paid semi-annually, and those bonds sell at their par value. ZZZ bonds have the same risk, maturity, and par value, as YYY bonds, but the ZZZ bonds pay a 4% monthly coupon. Neither bond is callable. At what price should the monthly payment bond sell

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts