Question: QUESTION 2 A stock redemption is always treated as a sale or exchange for tax purposes True O False QUESTION 3 A distribution from a

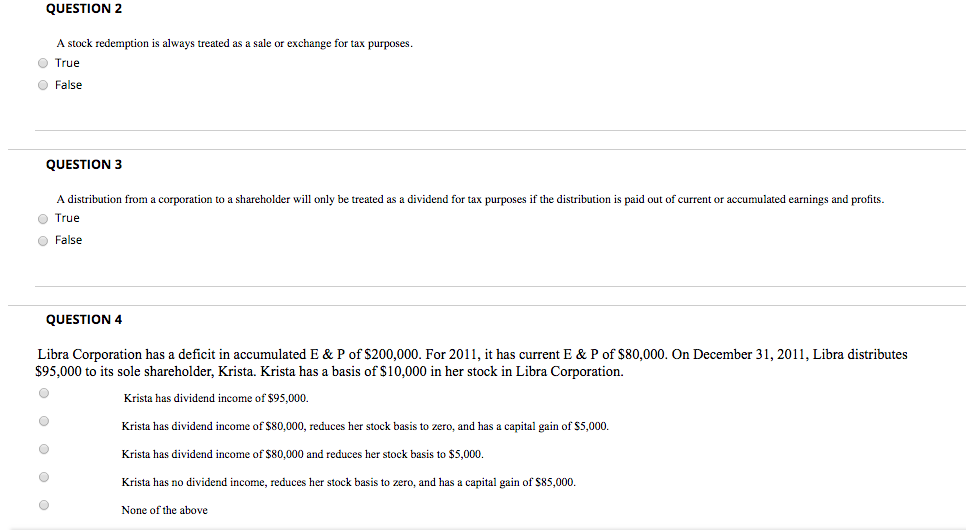

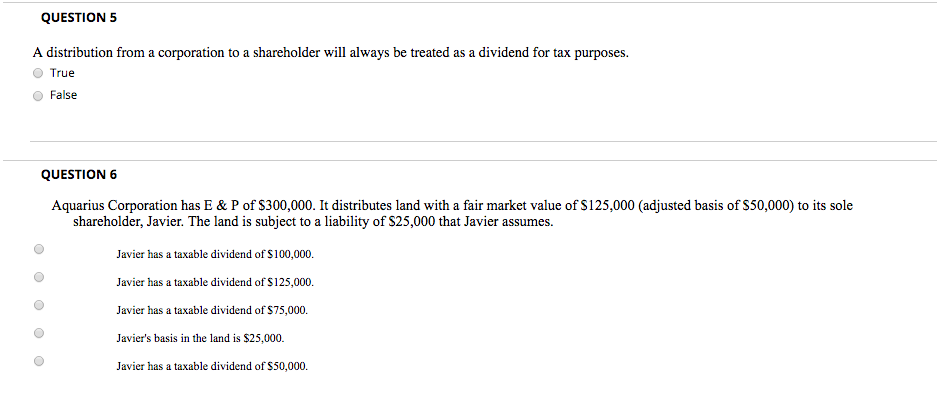

QUESTION 2 A stock redemption is always treated as a sale or exchange for tax purposes True O False QUESTION 3 A distribution from a corporation to a shareholder will only be treated as a dividend for tax purposes if the distribution is paid out of current or accumulated earnings and profits. True False QUESTION 4 Libra Corporation has a deficit in accumulated E & P of $200,000. For 201 , it has current E & P of S80,000. On December 3i, 2011, Libra distributes S95,000 to its sole shareholder, Krista. Krista has a basis of S10,000 in her stock in Libra Corporation. Krista has dividend income of $95,000. Krista has dividend income of $80,000, reduces her stock basis to zero, and has a capital gain of $5,000. Krista has dividend income of $80,000 and reduces her stock basis to $5,000. Krista has no dividend income, reduces her stock basis to zero, and has a capital gain of $85,000 None of the above QUESTION 5 A distribution from a corporation to a shareholder will always be treated as a dividend for tax purposes. O True False QUESTION 6 Aquarius Corporation has E & P of $300,000. It distributes land with a fair market value of S125,000 (adjusted basis of S50,000) to its sole shareholder, Javier. The land is subject to a liability of $25,000 that Javier assumes Javier has a taxable dividend of S100,000. Javier has a taxable dividend of S125,000. Javier has a taxable dividend of $75,000 Javier's basis in the land is $25,000. Javier has a taxable dividend of S50,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts