Question: QUESTION 2 A . The income statement for Division ( A ) is as follows: Division A Income statement for the year ended

QUESTION

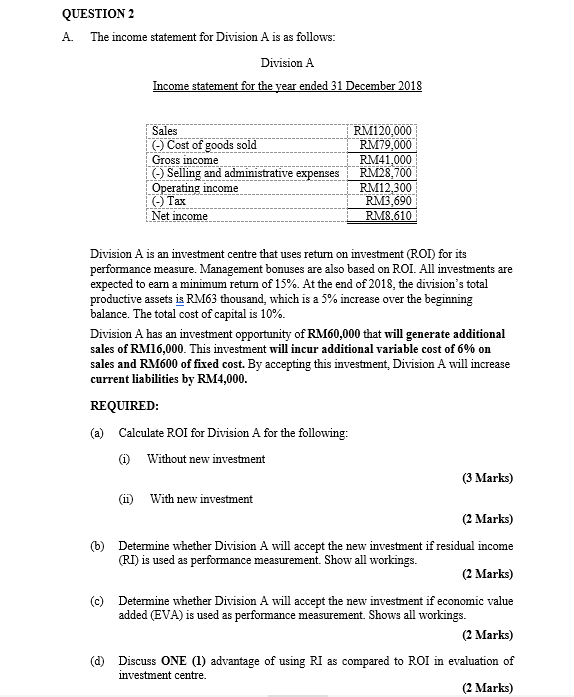

A The income statement for Division A is as follows:

Division A

Income statement for the year ended December

Division A is an investment centre that uses return on investment ROI for its performance measure. Management bonuses are also based on ROI. All investments are expected to earn a minimum return of At the end of the division's total productive assets is RM thousand, which is a increase over the beginning balance. The total cost of capital is

Division A has an investment opportunity of RM that will generate additional sales of RM This investment will incur additional variable cost of on sales and RM of fixed cost. By accepting this investment, Division A will increase current liabilities by RM

REQUIRED:

a Calculate ROI for Division A for the following:

i Without new investment

Marks

ii With new investment

Marks

b Determine whether Division A will accept the new investment if residual income RI is used as performance measurement. Show all workings.

Marks

c Determine whether Division A will accept the new investment if economic value added EVA is used as performance measurement. Shows all workings.

Marks

d Discuss ONE advantage of using RI as compared to ROI in evaluation of investment centre.

Marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock