Question: Question 2. A UK company is evaluating a foreign direct investment project that has a salvage value of $10 million in nominal terms at the

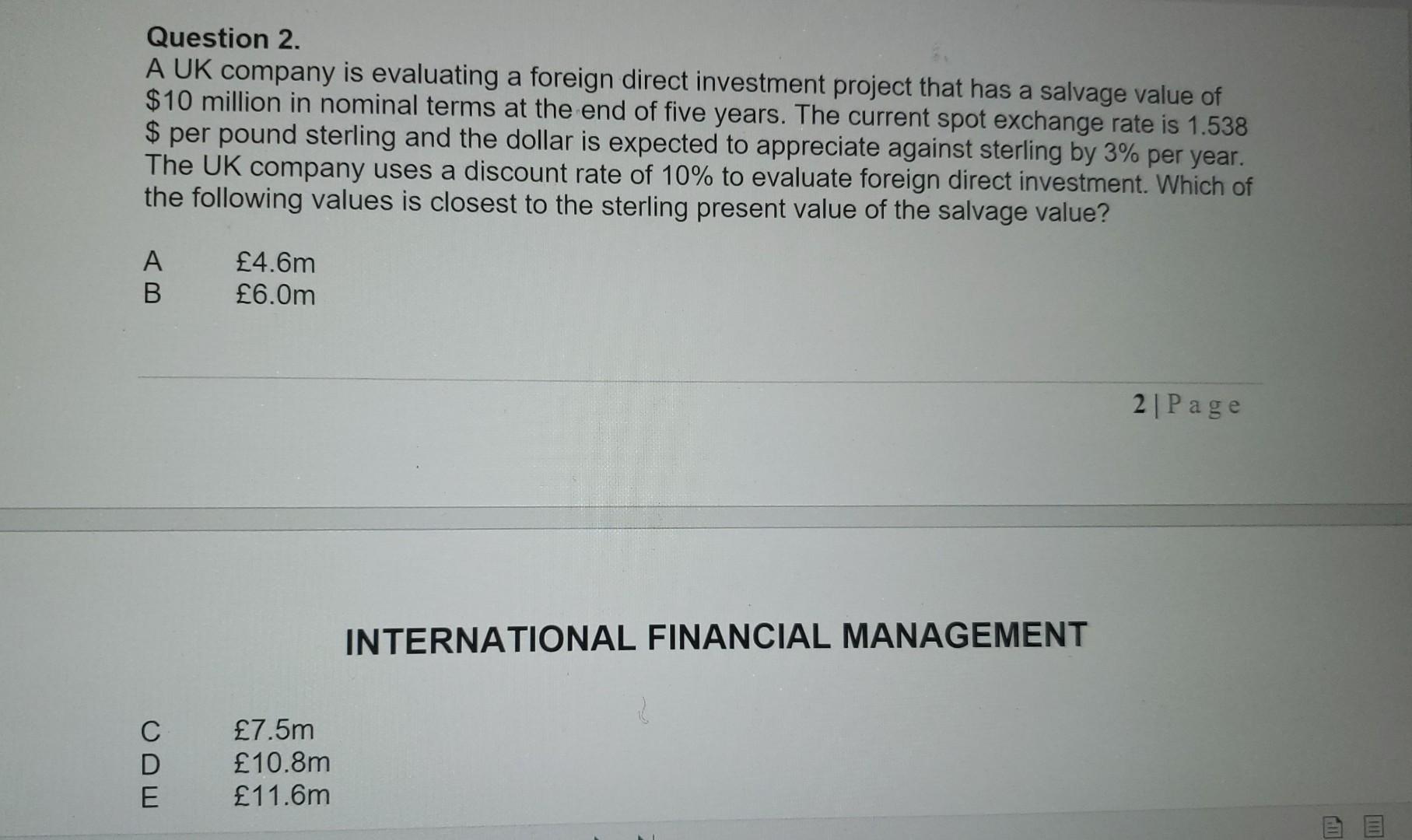

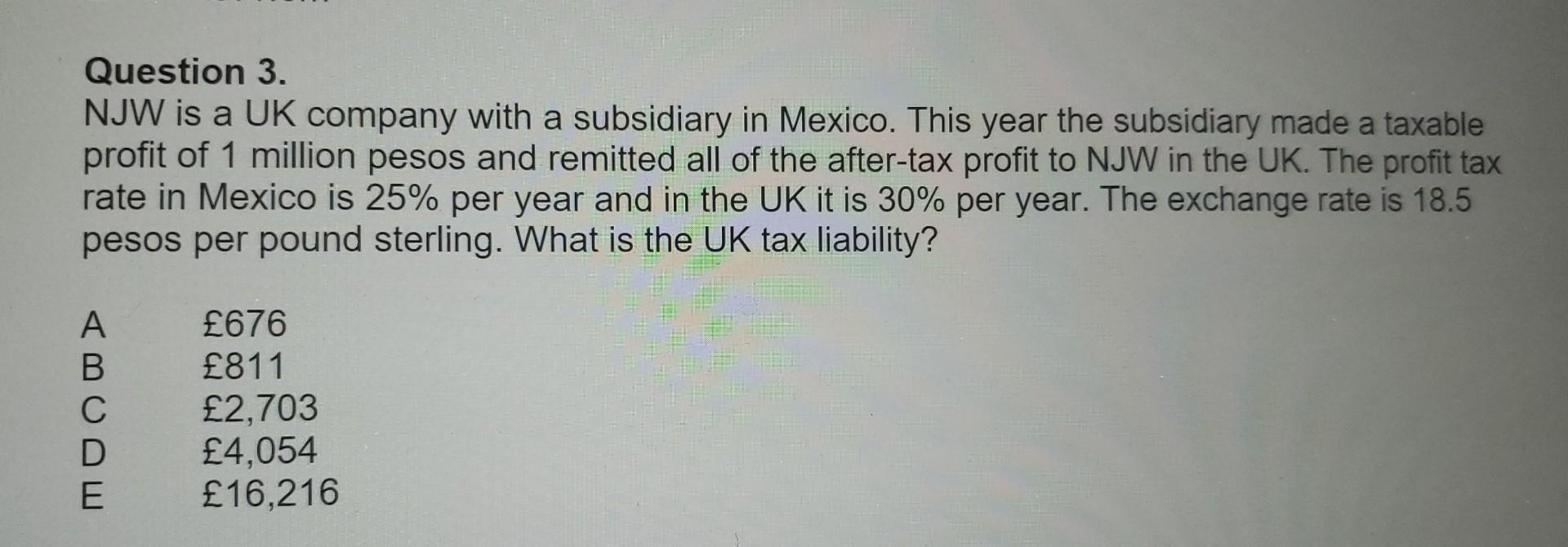

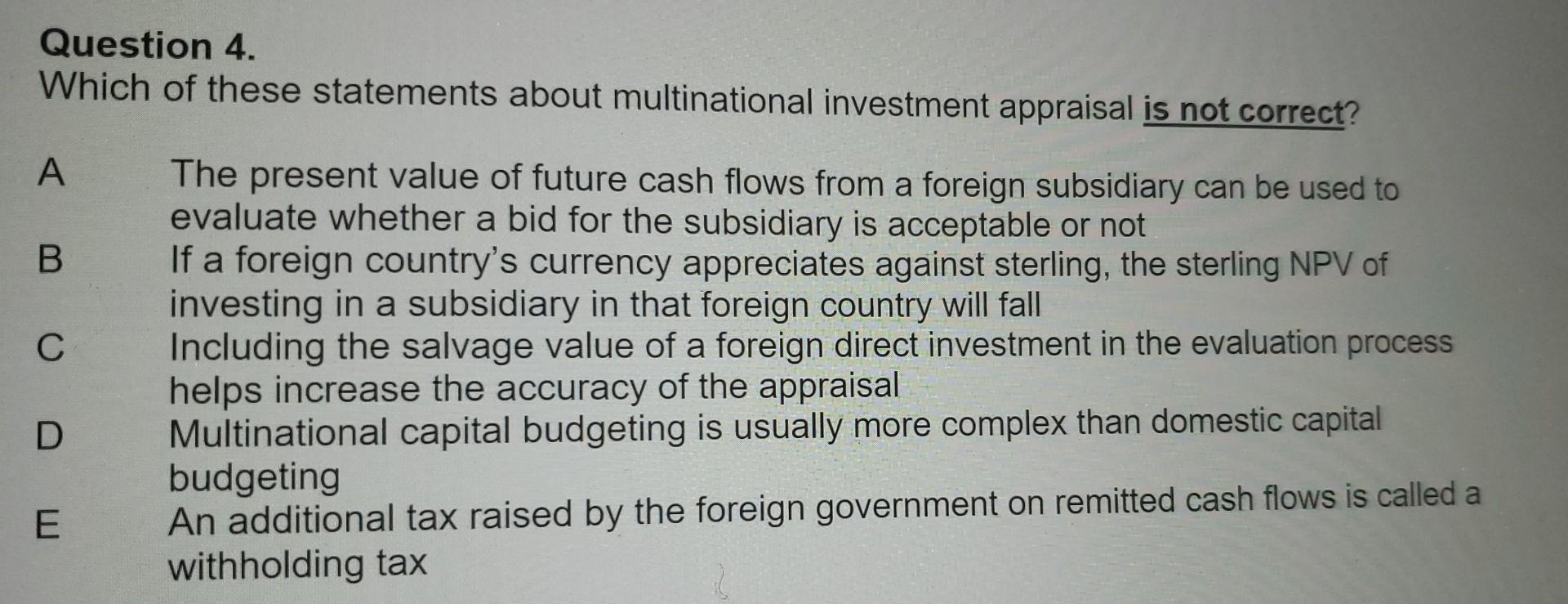

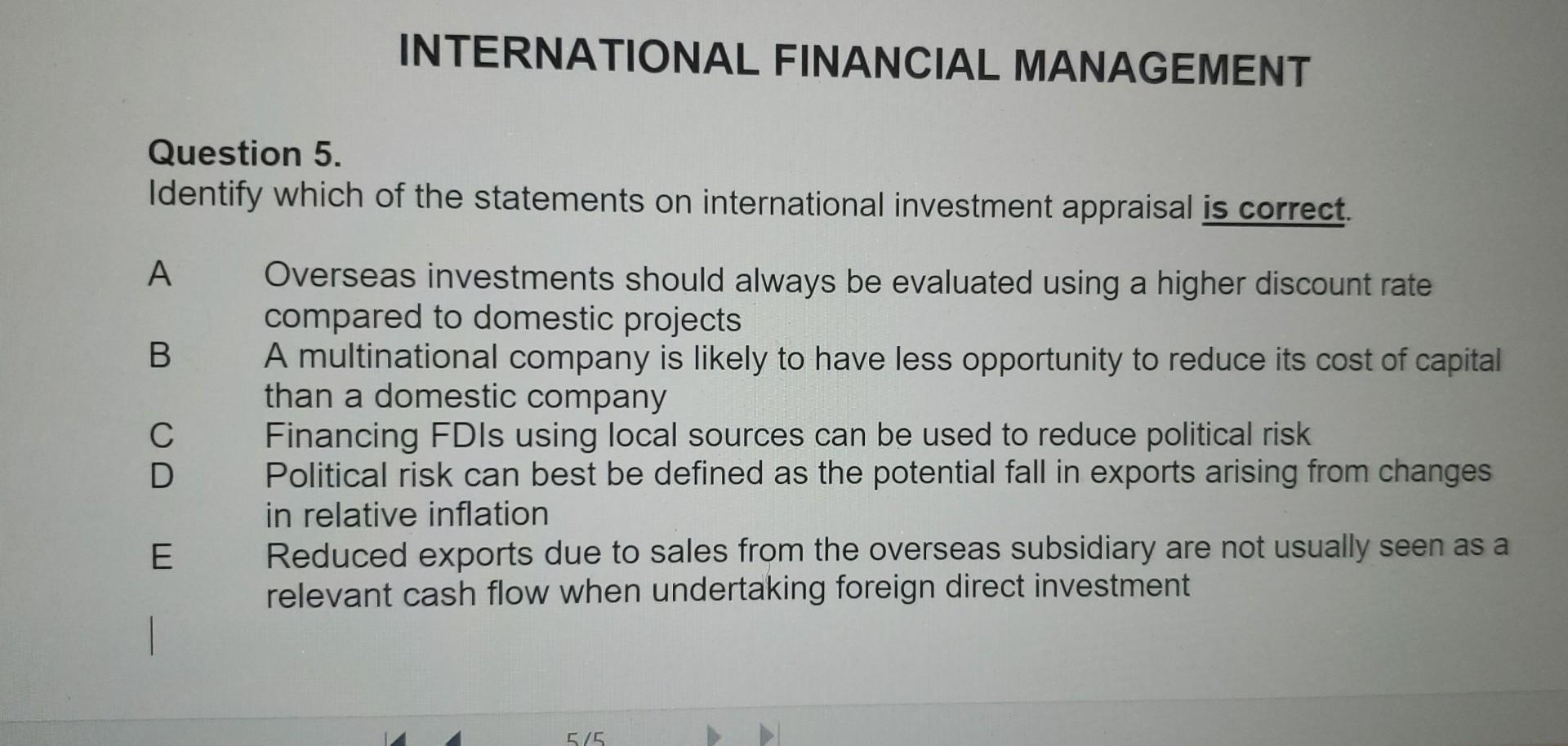

Question 2. A UK company is evaluating a foreign direct investment project that has a salvage value of $10 million in nominal terms at the end of five years. The current spot exchange rate is 1.538 $ per pound sterling and the dollar is expected to appreciate against sterling by 3% per year. The UK company uses a discount rate of 10% to evaluate foreign direct investment. Which of the following values is closest to the sterling present value of the salvage value? AB4.6m6.0m INTERNATIONAL FINANCIAL MANAGEMENT Question 3. NJW is a UK company with a subsidiary in Mexico. This year the subsidiary made a taxable profit of 1 million pesos and remitted all of the after-tax profit to NJW in the UK. The profit tax rate in Mexico is 25% per year and in the UK it is 30% per year. The exchange rate is 18.5 pesos per pound sterling. What is the UK tax liability? ABCDE6768112,7034,05416,216 Question 4. Which of these statements about multinational investment appraisal is not correct? A The present value of future cash flows from a foreign subsidiary can be used to evaluate whether a bid for the subsidiary is acceptable or not B If a foreign country's currency appreciates against sterling, the sterling NPV of investing in a subsidiary in that foreign country will fall C Including the salvage value of a foreign direct investment in the evaluation process helps increase the accuracy of the appraisal D Multinational capital budgeting is usually more complex than domestic capital budgeting E An additional tax raised by the foreign government on remitted cash flows is called a withholding tax Question 5. Identify which of the statements on international investment appraisal is correct. A Overseas investments should always be evaluated using a higher discount rate compared to domestic projects B A multinational company is likely to have less opportunity to reduce its cost of capital than a domestic company C Financing FDIs using local sources can be used to reduce political risk D Political risk can best be defined as the potential fall in exports arising from changes in relative inflation E Reduced exports due to sales from the overseas subsidiary are not usually seen as a relevant cash flow when undertaking foreign direct investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts