Question: Question 2 A. Using the Purchasing Power Parity (PPP) theory, the International Fisher Effect (IFE) theory and the Interest Rate Parity (IRP) theory, explain the

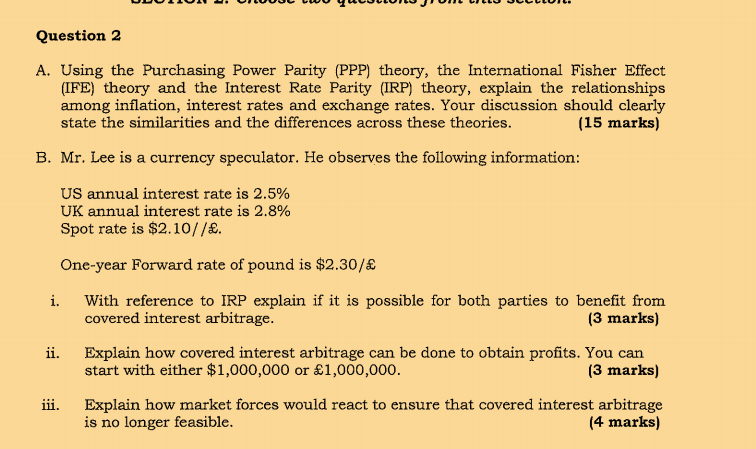

Question 2 A. Using the Purchasing Power Parity (PPP) theory, the International Fisher Effect (IFE) theory and the Interest Rate Parity (IRP) theory, explain the relationships among inflation, interest rates and exchange rates. Your discussion should clearly state the similarities and the differences across these theories. (15 marks) B. Mr. Lee is a currency speculator. He observes the following information: US annual interest rate is 2.5% UK annual interest rate is 2.8% Spot rate is $2.10//. One-year Forward rate of pound is $2.30/ i. With reference to IRP explain if it is possible for both parties to benefit from covered interest arbitrage. (3 marks) ii. Explain how covered interest arbitrage can be done to obtain profits. You can start with either $1,000,000 or 1,000,000. (3 marks) iii. Explain how market forces would react to ensure that covered interest arbitrage is no longer feasible. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts