Question: Question 2 a) Using the trial balance extract below, prepare an income statement for Creative Solutions for the year ended 31 December 2020. 10 marks

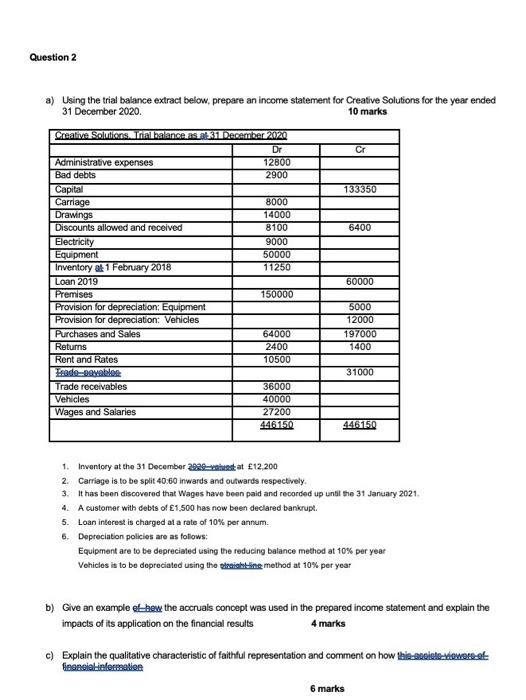

Question 2 a) Using the trial balance extract below, prepare an income statement for Creative Solutions for the year ended 31 December 2020. 10 marks Creative Solutions. Trial balance as at 31 December 2020 Dr Cr Administrative expenses 12800 Bad debts 2900 Capital 133350 Carriage 8000 Drawings 14000 Discounts allowed and received 8100 6400 Electricity 9000 Equipment 50000 Inventory at 1 February 2018 11250 Loan 2019 60000 Premises 150000 Provision for depreciation: Equipment 5000 Provision for depreciation: Vehicles 12000 Purchases and Sales 64000 197000 Returns 2400 1400 Rent and Rates 10500 Leade-povable 31000 Trade receivables 36000 Vehicles 40000 Wages and Salaries 27200 446150 446150 1. Inventory at the 31 December 2009 at 12.200 2. Carriage is to be split 40.60 inwards and outwards respectively 3. It has been discovered that Wages have been paid and recorded up until the 31 January 2021 4. A customer with debts of E1.500 has now been declared bankrupt. 5. Loan interest is charged at a rate of 10% per annum. 6. Depreciation policies are as follows: Equipment are to be deprecialed using the reducing balance method at 10% per year Vehicles is to be depreciated using the listing method at 10% per year b) Give an example then the accruals concept was used in the prepared income statement and explain the impacts of its application on the financial results 4 marks c) Explain the qualitative characteristic of faithful representation and comment on how this accide-viewere et financial information 6 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts