Question: Question 2: a2 Milk Ltd Pty. Required reading: Chapters 5, Eun and Resnick (Textbook) a2 Milk is an Australian company specialising in producing fresh milk

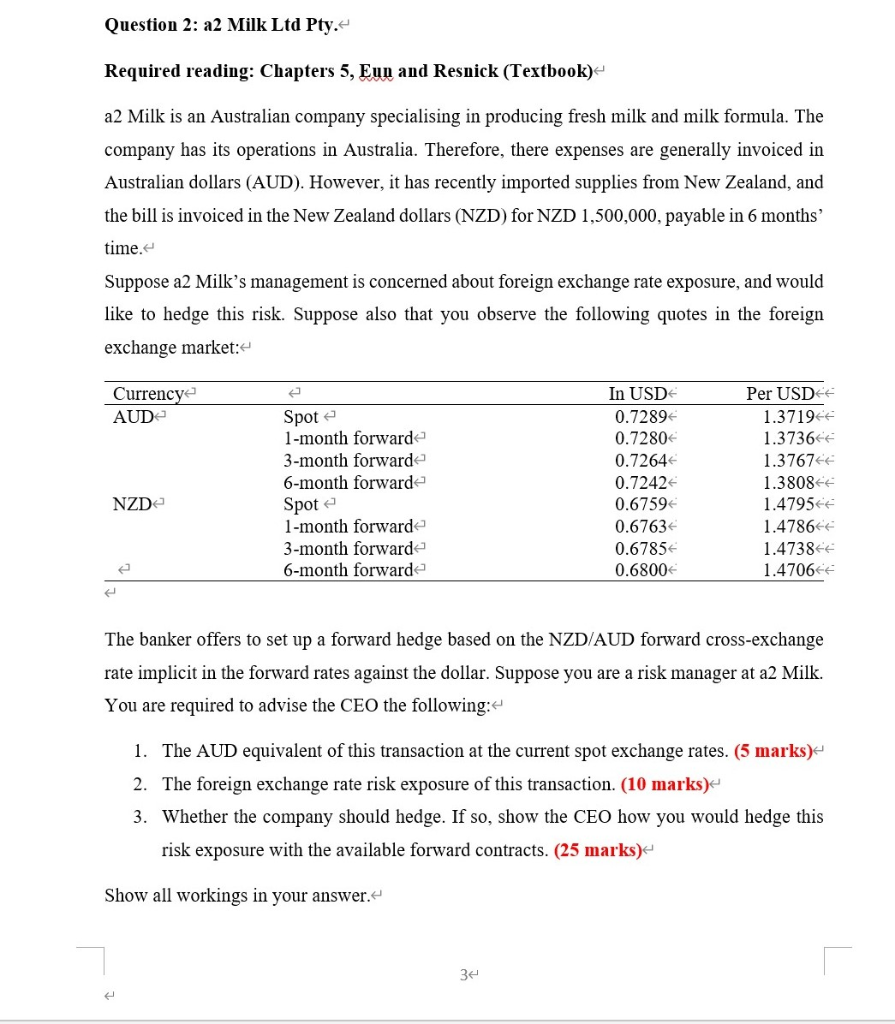

Question 2: a2 Milk Ltd Pty. Required reading: Chapters 5, Eun and Resnick (Textbook) a2 Milk is an Australian company specialising in producing fresh milk and milk formula. The company has its operations in Australia. Therefore, there expenses are generally invoiced in Australian dollars (AUD). However, it has recently imported supplies from New Zealand, and the bill is invoiced in the New Zealand dollars (NZD) for NZD 1,500,000, payable in 6 months' time. Suppose a2 Milks management is concerned about foreign exchange rate exposure, and would like to hedge this risk. Suppose also that you observe the following quotes in the foreign exchange market: Currency AUD Spot 1-month forward 3-month forward 6-month forward In USD 0.7289 0.7280 0.7264 0.72424 0.67594 0.67634 0.6785 0.6800 Per USD 1.37194 1.373664 1.37676 1.38084 1.479564 1.478666 1.47384 1.470666 NZD Spot 1-month forward 3-month forward 6-month forward The banker offers to set up a forward hedge based on the NZD AUD forward cross-exchange rate implicit in the forward rates against the dollar. Suppose you are a risk manager at a2 Milk. You are required to advise the CEO the following: 1. The AUD equivalent of this transaction at the current spot exchange rates. (5 marks) 2. The foreign exchange rate risk exposure of this transaction. (10 marks) 3. Whether the company should hedge. If so, show the CEO how you would hedge this risk exposure with the available forward contracts. (25 marks) Show all workings in your answer. 34

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts