Question: question 2 a,b, & c U ab , x' po AaBbCcDc AaBbc 15, O. A Aa A A 1 Normal - - AL 1 No

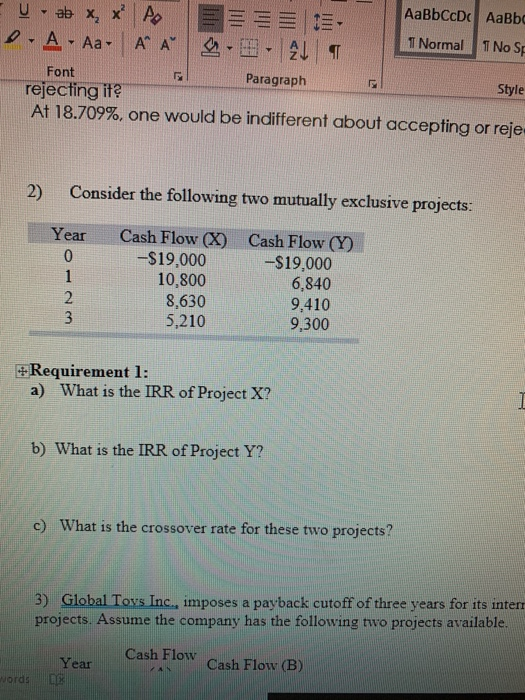

U ab , x' po AaBbCcDc AaBbc 15, O. A Aa A A 1 Normal - - AL 1 No SP Font Paragraph Style rejecting it? At 18.709%, one would be indifferent about accepting or reje 2) Consider the following two mutually exclusive projects: Year Cash Flow (X) -$19,000 10,800 8,630 5,210 Cash Flow (Y) -$19.000 6,840 9.410 9,300 Requirement 1: a) What is the IRR of Project X? b) What is the IRR of Project Y? c) What is the crossover rate for these two projects? 3) Global Toys Inc., imposes a payback cutoff of three years for its inter projects. Assume the company has the following two projects available. Cash Flow Cash Flow (B) Year Cash Flow Words De

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts