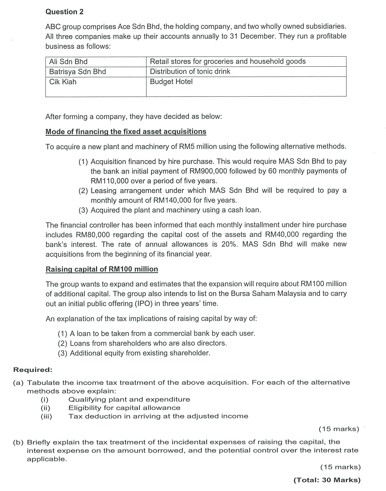

Question: Question 2 ABC group comprises Ace Sdn Bhd , the holding company, and two wholly owned subsidiaries. At three companies make up their accounts annualy

Question

ABC group comprises Ace Sdn Bhd the holding company, and two wholly owned subsidiaries.

At three companies make up their accounts annualy to December. They run a profitable

business as follows:

After forming a company, they have decided as below:

Mode of financing the fred asset acquisitions

To acquire a new plant and machinery of RM millon using the following alternative methods.

Acquisition financed by hire purchase. This would require MAS Sdn Bhd to pay

the bank an inibial payment of RMSC followed by montly payments of

RuM over a period of five years.

Leasing arrangement under which MAS Sdn Bhd will be required to pay a

monthly amount of RM for five years.

Acquired the plart and machinery using a cash loan.

The financial controller has been informed that each monthly installment under hire purchase

includes RMB regarding the capital cost of the assets and RM regarding the

bank's interest. The rate of annual allowances is MAS Sdn Bhd will make new

acquisitions from the begirning of its financial year.

Baising capital of RM million

The group wants to expand and estimates that the expansion will require about RM million

of addrional capital. The group also intends to lst on the lursa Saham Malaysia and to carry

out an initial public offering IPO in three years" time.

An explanation of the tax implications of raising capital by way of:

A loan to be taken from a commercial bark by each user.

Loans from shareholders who are also directors.

Additional equity from existing shaneholder.

Required:

a Tabulate the income tax treatment of the above acquisition. For each of the alternative

methods above explain:

i Qualifying plant and expenditure

ii Eligibality for enpital allowance

iii Tax deduction in arriving at the adjusted income

marks

b Briefly explain the tax treatment of the incidental expenses of raising the capital, the

interest expense on the amount borrowed, and the potential control over the interest rate

applicable.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock