Question: Question 2 ABC US World ABC 1.00 Correlation Coefficients US 0.70 1.00 World 0.30 0.85 1.00 SD (%) 25 20 15 E(R) % 10

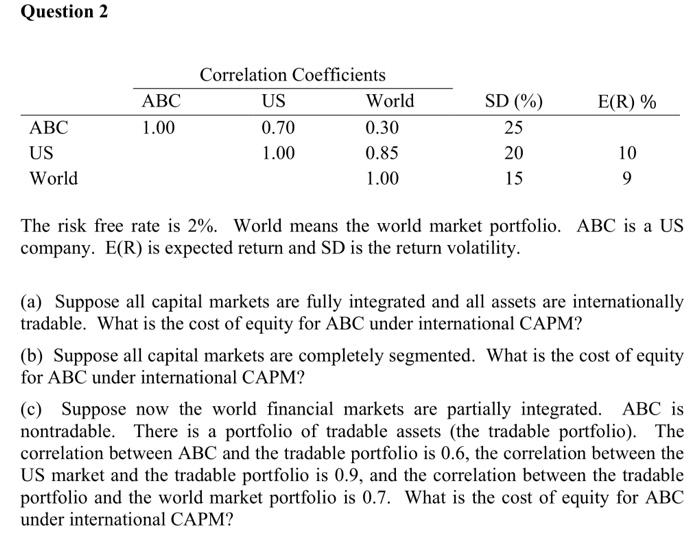

Question 2 ABC US World ABC 1.00 Correlation Coefficients US 0.70 1.00 World 0.30 0.85 1.00 SD (%) 25 20 15 E(R) % 10 9 The risk free rate is 2%. World means the world market portfolio. ABC is a US company. E(R) is expected return and SD is the return volatility. (a) Suppose all capital markets are fully integrated and all assets are internationally tradable. What is the cost of equity for ABC under international CAPM? (b) Suppose all capital markets are completely segmented. What is the cost of equity for ABC under international CAPM? (c) Suppose now the world financial markets are partially integrated. ABC is nontradable. There is a portfolio of tradable assets (the tradable portfolio). The correlation between ABC and the tradable portfolio is 0.6, the correlation between the US market and the tradable portfolio is 0.9, and the correlation between the tradable portfolio and the world market portfolio is 0.7. What is the cost of equity for ABC under international CAPM?

Step by Step Solution

3.36 Rating (162 Votes )

There are 3 Steps involved in it

a The cost of equity for ABC under international CAPM is given by Cost of Equity Rf ERm Rf Where Rf is the risk free rate is the beta of ABC and ERm i... View full answer

Get step-by-step solutions from verified subject matter experts