Question: Question 2: Accounting policies, estimates, errors & events after balance sheet date. State the correct accounting treatment for following two transactions. Show necessary calculations. I.

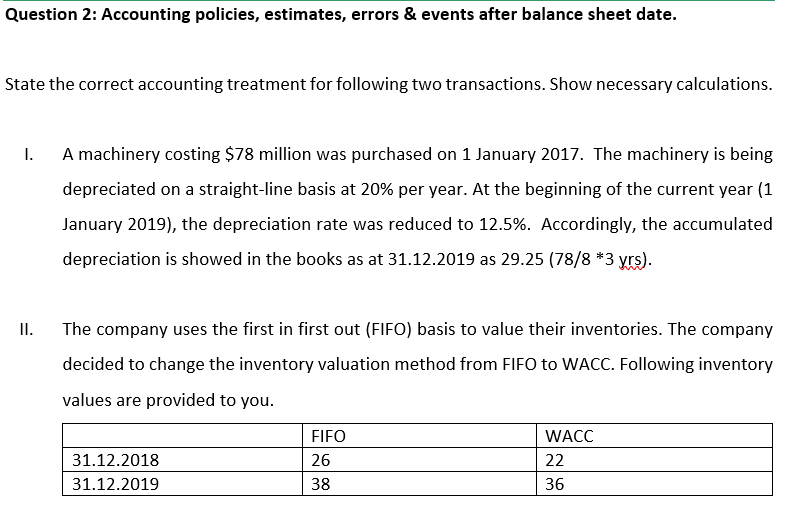

Question 2: Accounting policies, estimates, errors & events after balance sheet date. State the correct accounting treatment for following two transactions. Show necessary calculations. I. A machinery costing $78 million was purchased on 1 January 2017. The machinery is being depreciated on a straight-line basis at 20% per year. At the beginning of the current year (1 January 2019), the depreciation rate was reduced to 12.5%. Accordingly, the accumulated depreciation is showed in the books as at 31.12.2019 as 29.25 (78/8 *3 yrs). II. The company uses the first in first out (FIFO) basis to value their inventories. The company decided to change the inventory valuation method from FIFO to WACC. Following inventory values are provided to you. FIFO 26 31.12.2018 31.12.2019 WACC 22 36 38

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts