Question: Question 2 Active Portfolio Management (8 marks) Not yet saved Marked out of Consider a small economy that there are only two risky assets, Stock

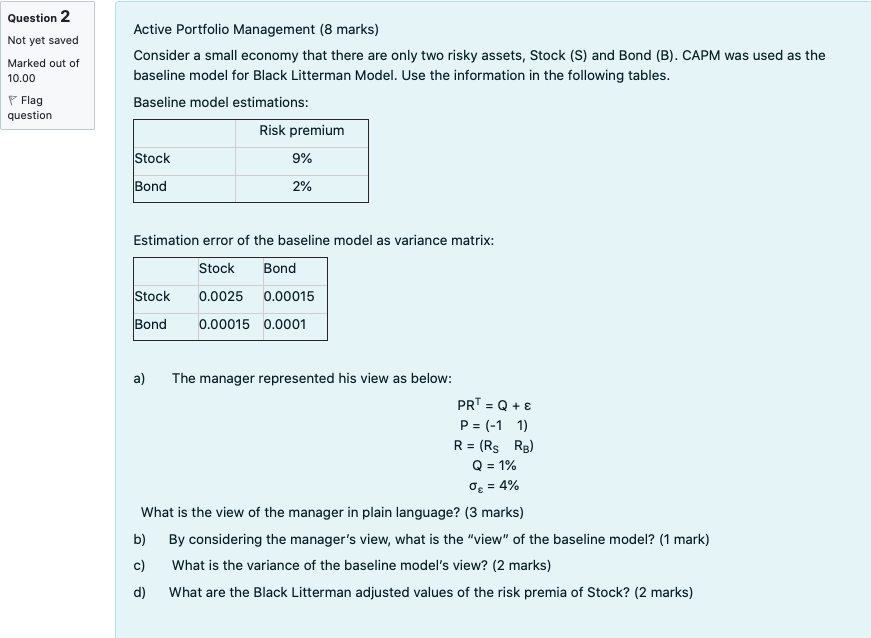

Question 2 Active Portfolio Management (8 marks) Not yet saved Marked out of Consider a small economy that there are only two risky assets, Stock (S) and Bond (B). CAPM was used as the baseline model for Black Litterman Model. Use the information in the following tables. 10.00 Baseline model estimations: Flag question Risk premium Stock 9% Bond 2% Estimation error of the baseline model as variance matrix: Stock Bond Stock 0.0025 0.00015 Bond 0.00015 0.0001 a) The manager represented his view as below: PRT = Q + E P = (-1 1) R = (Rs RB) Q = 1% og = 4% What is the view of the manager in plain language? (3 marks) b) By considering the manager's view, what is the "view" of the baseline model? (1 mark) c) What is the variance of the baseline model's view? (2 marks) d) What are the Black Litterman adjusted values of the risk premia of Stock? (2 marks) Question 2 Active Portfolio Management (8 marks) Not yet saved Marked out of Consider a small economy that there are only two risky assets, Stock (S) and Bond (B). CAPM was used as the baseline model for Black Litterman Model. Use the information in the following tables. 10.00 Baseline model estimations: Flag question Risk premium Stock 9% Bond 2% Estimation error of the baseline model as variance matrix: Stock Bond Stock 0.0025 0.00015 Bond 0.00015 0.0001 a) The manager represented his view as below: PRT = Q + E P = (-1 1) R = (Rs RB) Q = 1% og = 4% What is the view of the manager in plain language? (3 marks) b) By considering the manager's view, what is the "view" of the baseline model? (1 mark) c) What is the variance of the baseline model's view? (2 marks) d) What are the Black Litterman adjusted values of the risk premia of Stock? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts