Question: Question 2 . Alpha Tech Ltd . The following financial information relates to Alpha Tech Ltd: Statement of profit or loss information for the last

Question Alpha Tech Ltd

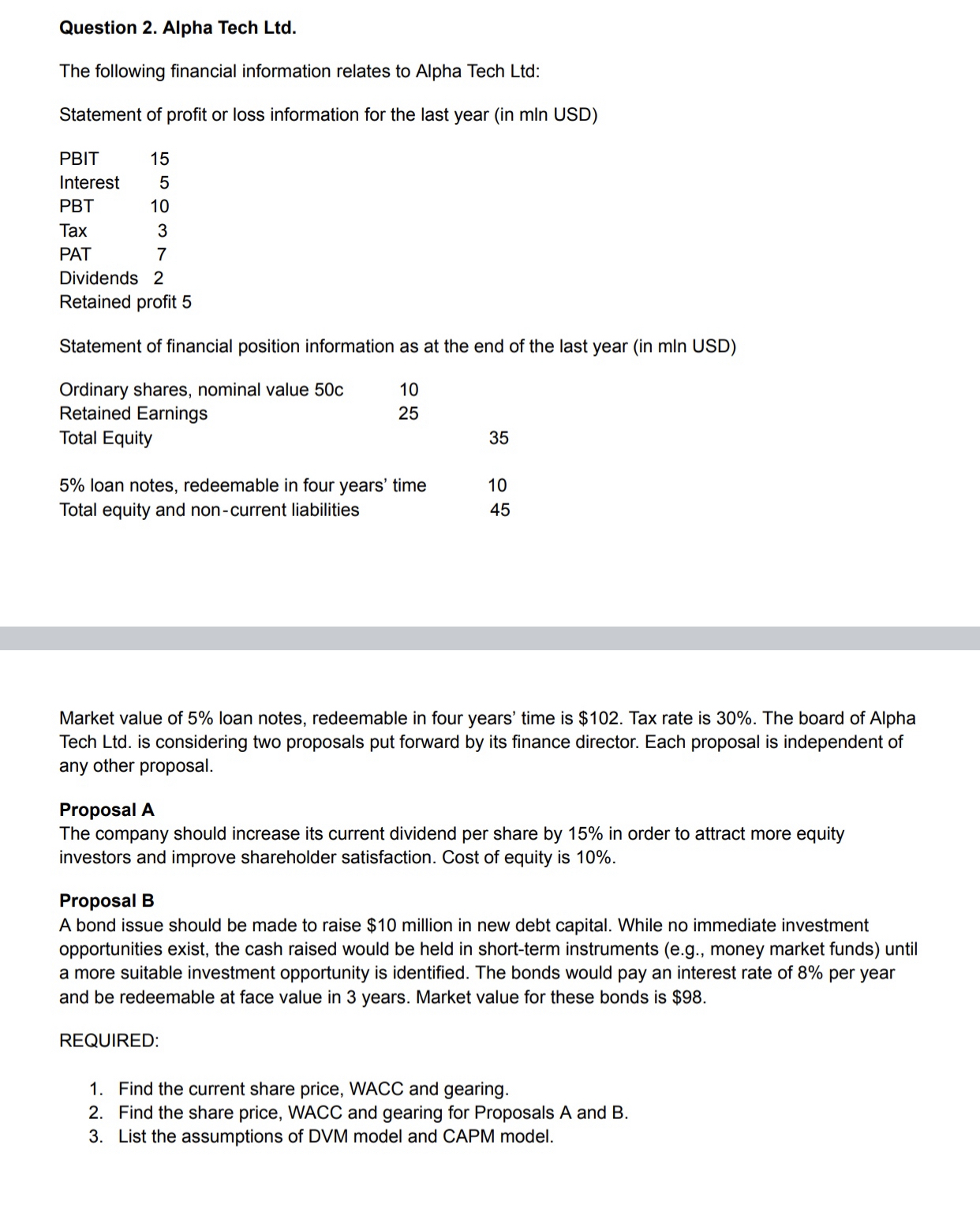

The following financial information relates to Alpha Tech Ltd:

Statement of profit or loss information for the last year in min USD

tablePBITInterestPBTTaxPATDividendsRetained profit

Statement of financial position information as at the end of the last year in min USD

tableOrdinary shares, nominal value cRetained Earnings,Total Equity,, loan notes, redeemable in four years' time,Total equity and noncurrent liabilities,

Market value of loan notes, redeemable in four years' time is $ Tax rate is The board of Alpha Tech Ltd is considering two proposals put forward by its finance director. Each proposal is independent of any other proposal.

Proposal A

The company should increase its current dividend per share by in order to attract more equity investors and improve shareholder satisfaction. Cost of equity is

Proposal B

A bond issue should be made to raise $ million in new debt capital. While no immediate investment opportunities exist, the cash raised would be held in shortterm instruments eg money market funds until a more suitable investment opportunity is identified. The bonds would pay an interest rate of per year and be redeemable at face value in years. Market value for these bonds is $

REQUIRED:

Find the current share price, WACC and gearing.

Find the share price, WACC and gearing for Proposals A and

List the assumptions of DVM model and CAPM model.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock