Question: Question 2 An investor is using the dividend valuation model to calculate the intrinsic values of two competing companies. The current market price of

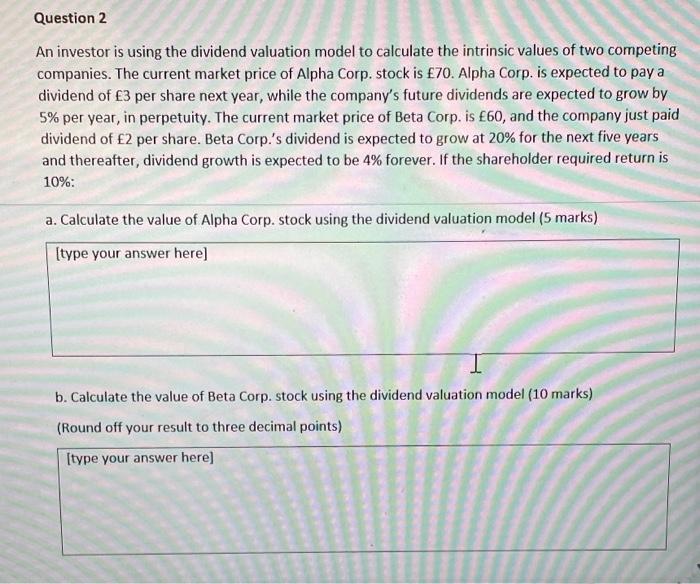

Question 2 An investor is using the dividend valuation model to calculate the intrinsic values of two competing companies. The current market price of Alpha Corp. stock is 70. Alpha Corp. is expected to pay a dividend of 3 per share next year, while the company's future dividends are expected to grow by 5% per year, in perpetuity. The current market price of Beta Corp. is 60, and the company just paid dividend of 2 per share. Beta Corp.'s dividend is expected to grow at 20% for the next five years and thereafter, dividend growth is expected to be 4% forever. If the shareholder required return is 10%: a. Calculate the value of Alpha Corp. stock using the dividend valuation model (5 marks) [type your answer here] b. Calculate the value of Beta Corp. stock using the dividend valuation model (10 marks) (Round off your result to three decimal points) [type your answer here]

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step 12 a To calculate the value of Alpha Corp stock using the dividend valuation model we use the f... View full answer

Get step-by-step solutions from verified subject matter experts