Question: Question 2 and 3: Consider the following data on Forster Co. Forster Co. Market Value Balance Sheet ($ Millions) Assets Liabilities Cost of Capital Cash

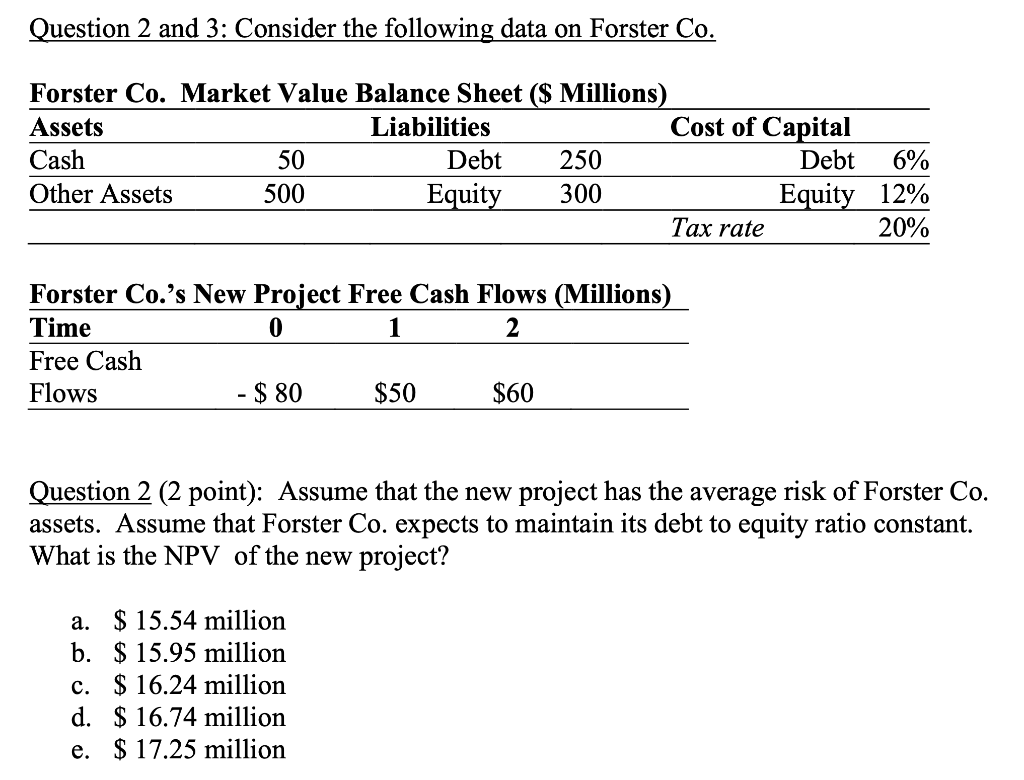

Question 2 and 3: Consider the following data on Forster Co. Forster Co. Market Value Balance Sheet ($ Millions) Assets Liabilities Cost of Capital Cash 50 Debt 250 Debt 6% Other Assets 500 Equity 300 Equity 12% Tax rate 20% Forster Co.'s New Project Free Cash Flows (Millions) Time 0 1 2 Free Cash Flows - $ 80 $50 $60 Question 2 (2 point): Assume that the new project has the average risk of Forster Co. assets. Assume that Forster Co. expects to maintain its debt to equity ratio constant. What is the NPV of the new project? a. $ 15.54 million b. $15.95 million c. $ 16.24 million d. $ 16.74 million e. $ 17.25 million

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock