Question: Question 2 and 3. Please show clear working so I can understand 2. Price a 6 month European put option with strike price $NZ1.30, written

Question 2 and 3. Please show clear working so I can understand

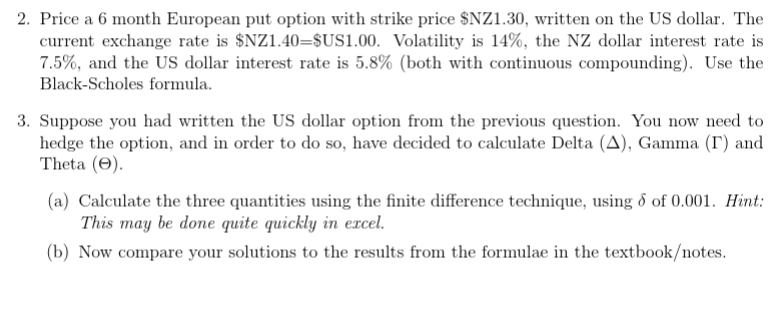

2. Price a 6 month European put option with strike price $NZ1.30, written on the US dollar. The 7.5%, and the US dollar interest rate is 5.8% (both with continuous compounding). Use the Black-Scholes formula. 3. Suppose you had written the US dollar option from the previous question. You now need to hedge the option, and in order to do so, have decided to calculate Delta (), Gamma () and Theta (). (a) Calculate the three quantities using the finite difference technique, using of 0.001 . Hint: This may be done quite quickly in excel. (b) Now compare your solutions to the results from the formulae in the textbookotes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts