Question: Question 2 and 3 PLEASE :) that two call options on a non-dividend-paying stock are trading for the 2. (5 points) Suppose One option has

Question 2 and 3 PLEASE :)

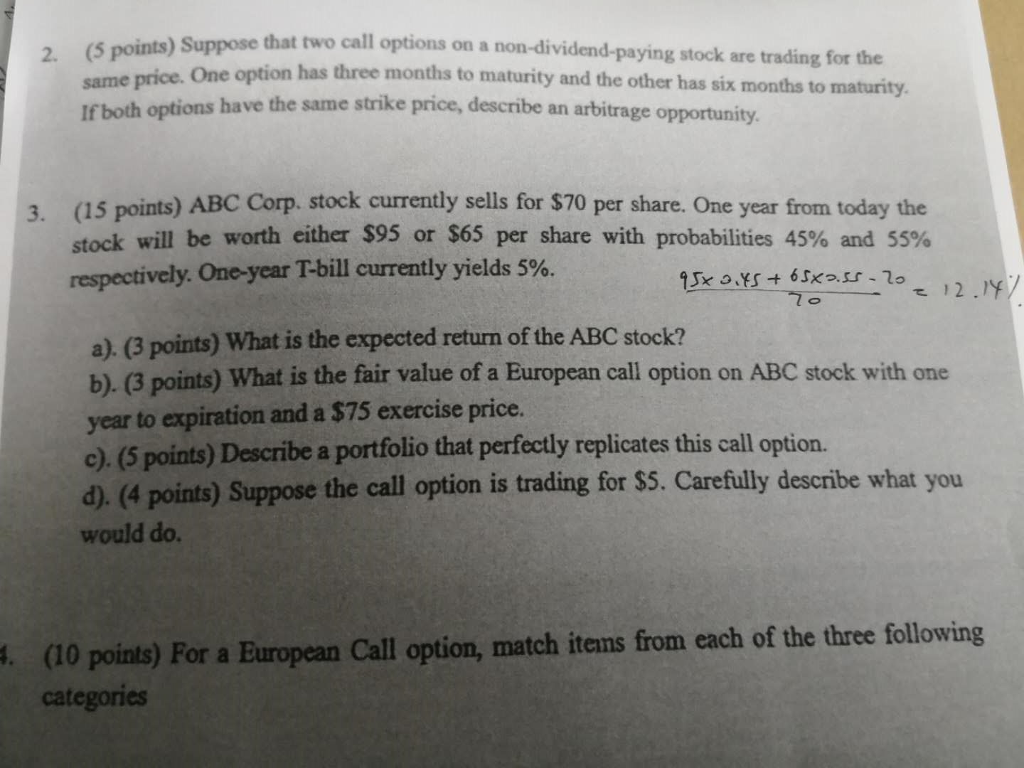

that two call options on a non-dividend-paying stock are trading for the 2. (5 points) Suppose One option has three months to maturity and the other has six months to maturity If both options have the same strike price, describe an arbitrage opportunity (15 points) ABC Corp. stock currently sells for $70 per share. One year from today the stock will be worth either $95 or $65 per share with probabilities 45% and 55% respectively. One-year T-bill currently yields 5%. 3. ?12IY/ a). (3 points) What is the expected return of the ABC stock? b). (3 points) What is the fair value of a European call option on ABC stock with one year to expiration and a $75 exercise price. e). (5 points) Describe a portfolio that perfectly replicates this call option. d). (4 points) Suppose the call option is trading for $5. Carefully describe what you would do. (10 points) For a European Call option, match itens from each of the three following categories

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts