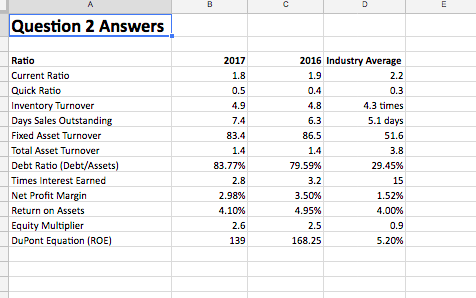

Question: Question 2 Answers Ratio Current Ratio Quick Ratio Inventory Turnover Days Sales Outstanding Fixed Asset Turnover Total Asset Turnover Debt Ratio (Debt/Assets Times Interest Earned

Question 2 Answers Ratio Current Ratio Quick Ratio Inventory Turnover Days Sales Outstanding Fixed Asset Turnover Total Asset Turnover Debt Ratio (Debt/Assets Times Interest Earned Net Profit Margin Return on Assets Equity Multiplier DuPont Equation (ROE) 2017 0.5 4.9 7.4 83.4 2016 Industry Average 2.2 0.3 4.3 times 5.1 days S1.6 1.9 0.4 4.B 6.3 86.5 83.77% 2.8 2.98% 4.10% 2.6 139 79.59% 3.2 3.50% 4.95% 2.5 168.25 29.45% 15 1.52% 4.00% 0.9 5.20%

Step by Step Solution

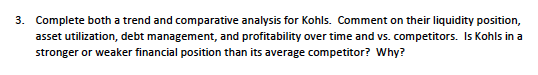

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock