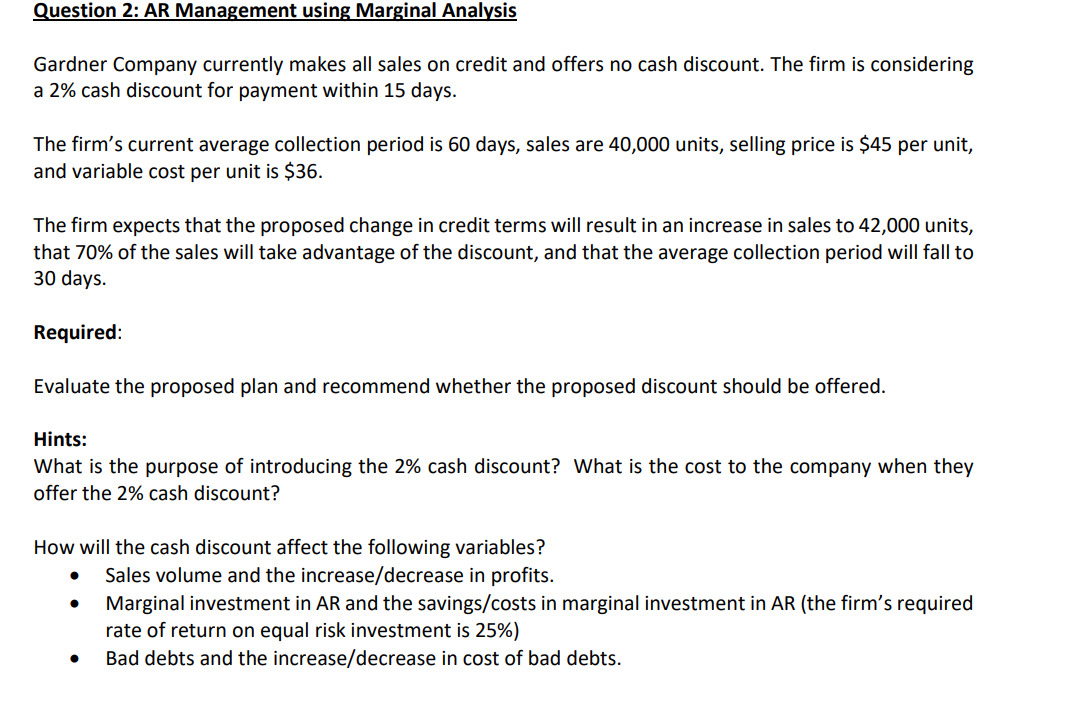

Question: Question 2: AR Management using Marginal Analysis Gardner Company currently makes all sales on credit and offers no cash discount. The firm is considering a

Question 2: AR Management using Marginal Analysis Gardner Company currently makes all sales on credit and offers no cash discount. The firm is considering a 2% cash discount for payment within 15 days. The firm's current average collection period is 60 days, sales are 40,000 units, selling price is $45 per unit, and variable cost per unit is $36. The firm expects that the proposed change in credit terms will result in an increase in sales to 42,000 units, that 70% of the sales will take advantage of the discount, and that the average collection period will fall to 30 days. Required: Evaluate the proposed plan and recommend whether the proposed discount should be offered. Hints: What is the purpose of introducing the 2% cash discount? What is the cost to the company when they offer the 2% cash discount? How will the cash discount affect the following variables? - Sales volume and the increase/decrease in profits. - Marginal investment in AR and the savings/costs in marginal investment in AR (the firm's required rate of return on equal risk investment is 25%) - Bad debts and the increase/decrease in cost of bad debts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts