Question: Question 2 Asia Brand Sdn Bhd ( ABSB ) was incorporated on 1 August 2 0 2 2 with paid up ordinary share capital of

Question

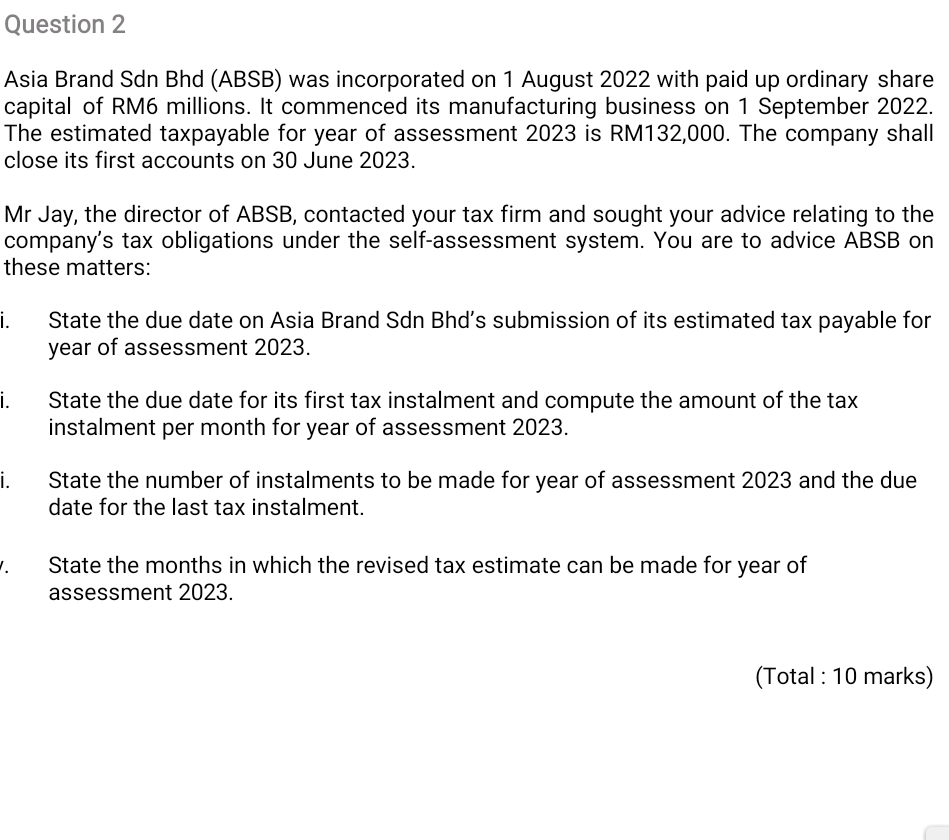

Asia Brand Sdn Bhd ABSB was incorporated on August with paid up ordinary share capital of RM millions. It commenced its manufacturing business on September The estimated taxpayable for year of assessment is RM The company shall close its first accounts on June

Mr Jay, the director of ABSB, contacted your tax firm and sought your advice relating to the company's tax obligations under the selfassessment system. You are to advice ABSB on these matters:

State the due date on Asia Brand Sdn Bhds submission of its estimated tax payable for year of assessment

State the due date for its first tax instalment and compute the amount of the tax instalment per month for year of assessment

State the number of instalments to be made for year of assessment and the due date for the last tax instalment.

State the months in which the revised tax estimate can be made for year of assessment

Total : marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock