Question: Question 2 Attempt any 8. (8x3=24 + 1 Bonus Point) 25 Marks 1. (Inflation and Interest Rates) What would you expect the nominal rate of

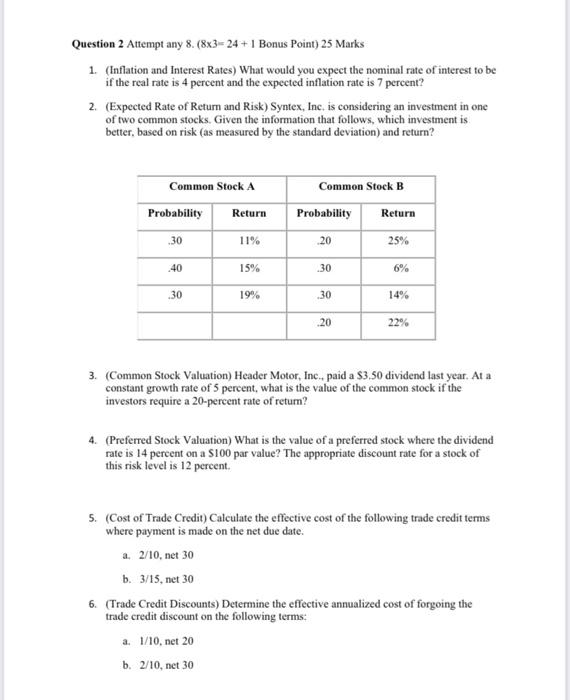

Question 2 Attempt any 8. (8x3=24 + 1 Bonus Point) 25 Marks 1. (Inflation and Interest Rates) What would you expect the nominal rate of interest to be if the real rate is 4 percent and the expected inflation rate is 7 percent? 2. (Expected Rate of Return and Risk) Syntex, Inc. is considering an investment in one of two common stocks. Given the information that follows, which investment is better, based on risk (as measured by the standard deviation) and return? Common Stock A Probability Return Common Stock B Probability Return 30 11% 20 25% .40 15% .30 6% 30 19% 30 14% 20 22% 3. (Common Stock Valuation) Header Motor, Inc. paid a $3.50 dividend last year. At a constant growth rate of 5 percent, what is the value of the common stock if the investors require a 20-percent rate of return? 4. (Preferred Stock Valuation) What is the value of a preferred stock where the dividend rate is 14 percent on a S100 par value? The appropriate discount rate for a stock of this risk level is 12 percent. 5. (Cost of Trade Credit) Calculate the effective cost of the following trade credit terms where payment is made on the net due date. a. 2/10, net 30 b. 3/15, net 30 6. (Trade Credit Discounts) Determine the effective annualized cost of forgoing the trade credit discount on the following terms: a. 1/10, net 20 b. 2/10, net 30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts