Question: Question 2 Axim Chalets Ltd (ACL) is a large chain of African resorts headquartered in Ghana. ACL prides itself in offering a unique African experience.

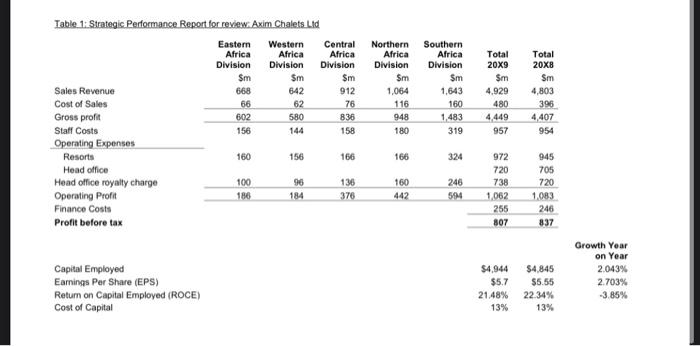

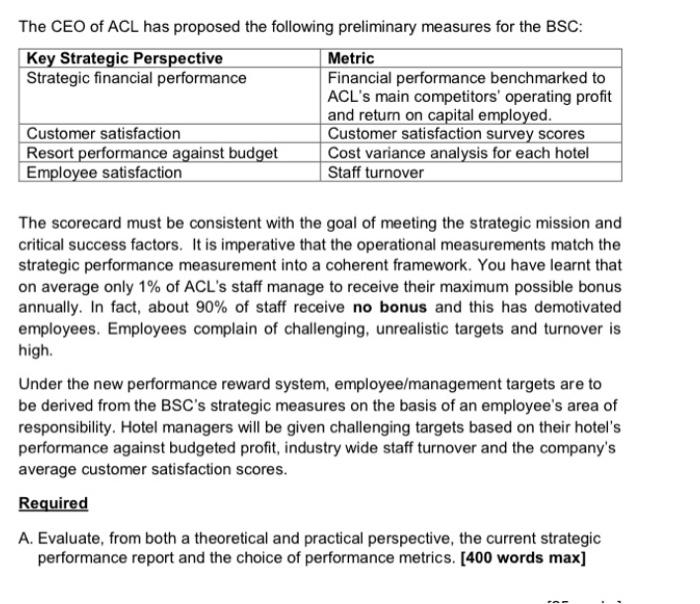

Question 2 Axim Chalets Ltd (ACL) is a large chain of African resorts headquartered in Ghana. ACL prides itself in offering a unique African experience. Its properties are all located on beachfronts and feature thatched huts residences. ACL's mission is, To become the No. 1 midscale all-inclusive resort chain in Africa - by creating unrivalled vacation experiences for customers, exceptional opportunities for employees, avant-garde products and services and continuously improving financial and environmental performance! ACL's corresponding critical success factors are linked to its mission. The subsidiary aims of the company are to maximise shareholders wealth and value. ACL's properties include numerous buildings which, in addition to offering residences, feature conference rooms, gyms, swimming pools, sports facilities, playgrounds and local community tours. The company operates as a five-division organisation for reporting purposes. These are namely, the Eastern Africa, Western Africa, Central Africa, Northern Africa and Southern Africa divisions. Recent divisional strategic performance information for the five divisions have been provided in table 1 below. The report informs the basis of the company's annual review by its board. At the operational level, each hotel manager is given an individual budget for their hotel, prepared in the finance department, and is judged by performance against budgeted profit. ACL intends to change its business model and introduce the balanced Scorecard (BSC) across its divisions. The company is thinking of selling half of its properties and leasing them back. Most hotels follow this strategy and ACL anticipates this will reduce the need to manage properties while enabling more focus on serving customers. Northern Africa Division Sm 1,064 116 948 180 Southern Africa Division Sm 1.643 Total 20x9 $m 4.929 480 4,449 957 Total 20x8 Sm 4,803 Table 1: Strategis. Performance Report for review. Axim Chalets Lid Eastern Western Central Africa Africa Africa Division Division Division Sm Sm Sm Sales Revenue 668 642 912 Cost of Sales 66 62 76 Gross profit 602 580 836 Staff Costs 156 144 158 Operating Expenses Resorts 156 166 Head office Head office royalty charge 100 96 136 Operating Profit 186 184 376 Finance Costs Profit before tax 160 396 1,483 319 4,407 954 166 324 160 442 246 594 972 720 738 1,062 255 807 945 705 720 1083 246 837 Capital Employed Earnings Per Share (EPS) Return on Capital Employed (ROCE) Cost of Capital $4,944 $5.7 21.48% 13% $4,845 $5.55 22 34% 13% Growth Year on Year 2.043% 2.703% -3.85% The CEO of ACL has proposed the following preliminary measures for the BSC: Key Strategic Perspective Metric Strategic financial performance Financial performance benchmarked to ACL's main competitors' operating profit and return on capital employed. Customer satisfaction Customer satisfaction survey scores Resort performance against budget Cost variance analysis for each hotel Employee satisfaction Staff turnover The scorecard must be consistent with the goal of meeting the strategic mission and critical success factors. It is imperative that the operational measurements match the strategic performance measurement into a coherent framework. You have learnt that on average only 1% of ACL's staff manage to receive their maximum possible bonus annually. In fact, about 90% of staff receive no bonus and this has demotivated employees. Employees complain of challenging, unrealistic targets and turnover is high. Under the new performance reward system, employee/management targets are to be derived from the BSC's strategic measures on the basis of an employee's area of responsibility. Hotel managers will be given challenging targets based on their hotel's performance against budgeted profit, industry wide staff turnover and the company's average customer satisfaction scores. Required A. Evaluate, from both a theoretical and practical perspective, the current strategic performance report and the choice of performance metrics. [400 words max] Question 2 Axim Chalets Ltd (ACL) is a large chain of African resorts headquartered in Ghana. ACL prides itself in offering a unique African experience. Its properties are all located on beachfronts and feature thatched huts residences. ACL's mission is, To become the No. 1 midscale all-inclusive resort chain in Africa - by creating unrivalled vacation experiences for customers, exceptional opportunities for employees, avant-garde products and services and continuously improving financial and environmental performance! ACL's corresponding critical success factors are linked to its mission. The subsidiary aims of the company are to maximise shareholders wealth and value. ACL's properties include numerous buildings which, in addition to offering residences, feature conference rooms, gyms, swimming pools, sports facilities, playgrounds and local community tours. The company operates as a five-division organisation for reporting purposes. These are namely, the Eastern Africa, Western Africa, Central Africa, Northern Africa and Southern Africa divisions. Recent divisional strategic performance information for the five divisions have been provided in table 1 below. The report informs the basis of the company's annual review by its board. At the operational level, each hotel manager is given an individual budget for their hotel, prepared in the finance department, and is judged by performance against budgeted profit. ACL intends to change its business model and introduce the balanced Scorecard (BSC) across its divisions. The company is thinking of selling half of its properties and leasing them back. Most hotels follow this strategy and ACL anticipates this will reduce the need to manage properties while enabling more focus on serving customers. Northern Africa Division Sm 1,064 116 948 180 Southern Africa Division Sm 1.643 Total 20x9 $m 4.929 480 4,449 957 Total 20x8 Sm 4,803 Table 1: Strategis. Performance Report for review. Axim Chalets Lid Eastern Western Central Africa Africa Africa Division Division Division Sm Sm Sm Sales Revenue 668 642 912 Cost of Sales 66 62 76 Gross profit 602 580 836 Staff Costs 156 144 158 Operating Expenses Resorts 156 166 Head office Head office royalty charge 100 96 136 Operating Profit 186 184 376 Finance Costs Profit before tax 160 396 1,483 319 4,407 954 166 324 160 442 246 594 972 720 738 1,062 255 807 945 705 720 1083 246 837 Capital Employed Earnings Per Share (EPS) Return on Capital Employed (ROCE) Cost of Capital $4,944 $5.7 21.48% 13% $4,845 $5.55 22 34% 13% Growth Year on Year 2.043% 2.703% -3.85% The CEO of ACL has proposed the following preliminary measures for the BSC: Key Strategic Perspective Metric Strategic financial performance Financial performance benchmarked to ACL's main competitors' operating profit and return on capital employed. Customer satisfaction Customer satisfaction survey scores Resort performance against budget Cost variance analysis for each hotel Employee satisfaction Staff turnover The scorecard must be consistent with the goal of meeting the strategic mission and critical success factors. It is imperative that the operational measurements match the strategic performance measurement into a coherent framework. You have learnt that on average only 1% of ACL's staff manage to receive their maximum possible bonus annually. In fact, about 90% of staff receive no bonus and this has demotivated employees. Employees complain of challenging, unrealistic targets and turnover is high. Under the new performance reward system, employee/management targets are to be derived from the BSC's strategic measures on the basis of an employee's area of responsibility. Hotel managers will be given challenging targets based on their hotel's performance against budgeted profit, industry wide staff turnover and the company's average customer satisfaction scores. Required A. Evaluate, from both a theoretical and practical perspective, the current strategic performance report and the choice of performance metrics. [400 words max]